Free Download: Year-End Accounting Checklist

We are excited to present this comprehensive and practical Year-End Accounting Checklist for Nonprofits, specifically designed to simplify your financial close processes. As we understand the critical importance of accurate and timely year-end reporting, this downloadable resource is tailored to help nonprofit organizations, churches, and similar entities ensure their financials are in perfect shape.

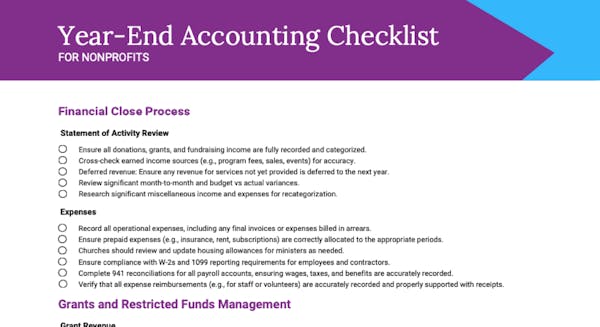

The Year-End Accounting Checklist encompasses all essential components of nonprofit financial management. From reconciling payroll accounts to ensuring compliance with reporting requirements, the guide provides a step-by-step framework to streamline your financial review and preparation process.

Talk to an expert

For bookkeeping and accounting support beyond this checklist, get in touch with the Jitasa team.

Request a QuoteRelated Resources

If you’re interested in investing in a trained accountant to help your nonprofit ensure transparency and accountability in finances, conduct your research. Here are some additional resources you can look into for more guidance:

Working With a Nonprofit Accountant: What to Expect

Working with an accountant can help your organization develop an effective budget. Read more about what an accountant can do for you in this comprehensive article.

What to ExpectGiving Tuesday Best Practices to Align Fundraising and Finances

Preparing for Giving Tuesday? Read more about best practices to align your campaign with your financial team with this comprehensive article.

Read PostBookkeeping and Accounting for Nonprofits

Looking to hire or outsource a finance team? Learn more about Jitasa’s services for nonprofits and how we can help you with your bookkeeping and accounting.

Jitasa's Services