Year-End Giving: How to Create a Financially Sound Strategy

Friday, October 10, 2025 by Delanie Miller

It’s no secret that the end of the year is a busy time for nonprofits like yours. Giving tends to spike during this season, so your fundraising and development teams need to plan effective campaigns and engage your supporters one final time this year. At the same time, your leaders and finance team have to close the books on the fiscal year, create and analyze reports, and make sure financial plans are ready to go for the new year.

While you might treat fundraising and financial management as separate tasks, they need to work together for the best possible results. In this guide, we’ll explore how to take a balanced approach to your nonprofit’s year-end giving season by covering the following topics:

- What is year-end giving?

- Why is year-end fundraising important for nonprofits?

- An Overview of Year-End Financial Management

- Tips for Coordinating Year-End Giving & Financial Management

By aligning your fundraising and financial strategies at year-end, you’ll set your nonprofit up for lasting success into the new year and beyond. Let’s dive in!

Simplify year-end financial management by partnering with the experts at Jitasa.

Request a QuoteWhat is year-end giving?

Year-end giving encompasses all donations made to your nonprofit in the last few weeks or months of the calendar year. Many organizations use GivingTuesday to mark the start of this season, although a few say it begins on December 1 for consistency and alignment with their operating budgets.

Either way, planning for this season should start several months in advance—minimally in October, although depending on your team’s bandwidth and the scale of your efforts, you could begin as early as July. No matter when you start, make sure to organize a cohesive year-end giving campaign. While many donations will likely come in in December just because of societal trends, a solid strategy will help you maximize this critical fundraising period for your mission.

Why is year-end fundraising important for nonprofits?

Donors are particularly motivated to contribute to the nonprofits and causes that matter to them at the end of the year for two main reasons: the holiday season brings a spirit of generosity with it that makes them want to give back to their communities, and they have the opportunity to claim one last tax benefit before they file for that year.

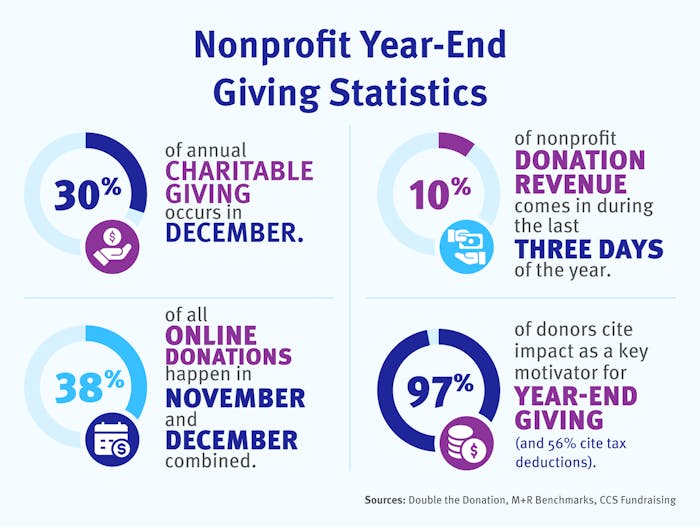

Regardless of which reason is more inspirational for your particular supporters, there is no doubt that year-end giving is critical for the entire nonprofit sector, especially when you look at the data:

- 30% of annual charitable giving occurs in December.

- 10% of nonprofit donation revenue comes in during the last three days of the year.

- 38% of all online donations happen in November and December.

- 97% of donors cite their gift’s impact as a major reason for contributing at the end of the year, although 56% indicate that tax deduction is still a significant motivator.

External factors naturally affect these statistics—for example, the exact distribution of online gifts made in November vs. December depends on when GivingTuesday occurs, and more donations tend to come in on December 31 if it falls on a weekday rather than a weekend. However, it’s clear that focusing on year-end giving provides much-needed revenue to close out the year well and build a foundation for sustaining your programs and operations in the new year.

An Overview of Year-End Financial Management

With a few exceptions, most nonprofits’ fiscal year follows the calendar year. So, while your team is managing its year-end fundraising, you’ll also need to wrap up your financial activities for this year and prepare for next year.

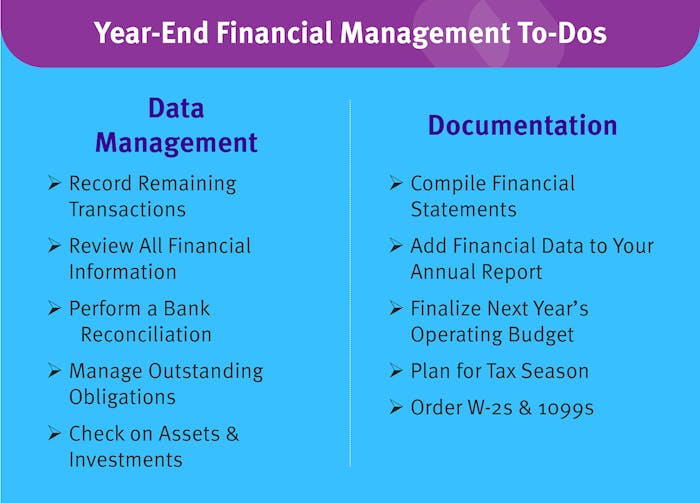

Year-end financial management involves completing a variety of tasks, some related to data management and some to documentation. Here are a few of the most critical activities you should add to your to-do list:

- Record all remaining transactions so you have complete data on the revenue your nonprofit brought in and the expenses it incurred during the year.

- Review all collected financial information from the year to ensure you’re practicing good data hygiene and to reduce the risk of creating inaccurate reports.

- Perform a final bank reconciliation to confirm that your internal records match the transaction information your bank has on file.

- Manage outstanding financial obligations by paying any unpaid bills or invoices you can and reviewing your accounts receivable and payable.

- Check on your nonprofit’s assets and investments, noting any categorization errors or other management issues you need to address.

- Compile annual financial statements, including your nonprofit’s statements of activities, financial position, cash flows, and functional expenses, to summarize data in actionable ways.

- Create the financial section of your annual report, which should cover the year’s spending and fundraising highlights and direct readers to your attached financial statements if they want to learn more.

- Finalize next year’s operating budget and submit it to your organization’s board for approval.

- Plan for tax season so your nonprofit can meet its Form 990 filing deadline—May 15 for organizations that follow the calendar fiscal year.

- Order W-2s and 1099s for each of your employees and contractors (respectively) to ensure you can issue them by their January 31 due date.

Just as your year-end giving campaign requires fundraising, development, marketing, and other departments to work together for success, year-end financial management is also a team effort. While your CFO, bookkeeper, and accountant will do most of the heavy lifting, other leaders and board members should also be involved to ensure everything gets done efficiently and to the benefit of your entire organization.

Stay on top of your nonprofit's year-end accounting processes with our comprehensive checklist.

Download for FreeTips for Coordinating Year-End Giving & Financial Management

Now that you understand the importance of year-end giving and fiscal year wrap-up tasks for nonprofits, let’s look at some actions you can take to conduct your final fundraising push of the year in a financially responsible way.

Set Clear Year-End Fundraising Goals

For any initiative your nonprofit launches, clear goals are essential to keep your team’s efforts on the right track. While your main objective for your year-end giving campaign will likely concern the amount of revenue you hope to raise, you might also set goals that relate to engaging supporters and spreading awareness about your mission. No matter what you decide you want to achieve, make sure your goals align with your in-progress operating budget for next year, as well as your ongoing or upcoming strategic plan.

Once you have a general idea of what you want to accomplish, make your year-end giving goals actionable using the SMART method, meaning they should be:

- Specific about what success looks like.

- Measurable—i.e., indicating a specific number or percentage you want to hit.

- Attainable based on past year-end fundraising data and your nonprofit’s current capacity.

- Relevant to your mission and upcoming initiatives.

- Time-bound with a clear start and end date.

Keeping these parameters in mind, an example of a SMART year-end giving goal might be “to raise $50,000 ($3,000 more than we did during our last year-end campaign as we’re in a better financial position now) to sustain our ongoing community programs between GivingTuesday and the end of the day on December 31.”

Offer Multiple Ways to Contribute

Especially if donors make their biggest (or only!) charitable contribution of the year in December, they’ll be more likely to choose your organization if you let them give how they want to. Plus, diversifying your year-end fundraising strategy makes you more likely to reach your goal by providing backup revenue streams you can rely on in case unexpected shortfalls or expenses arise.

Let’s look at some of the best options for year-end giving based on the five major categories of nonprofit revenue.

Individual Donations

Individual donations will likely make up the bulk of your organization’s year-end contributions. Allow donors to choose from a variety of donation methods, such as:

- Responding to a direct mail solicitation by sending a check in a prepaid return envelope or by scanning a QR code to your online donation page.

- Texting a special year-end keyword to your nonprofit’s text-to-give number.

- Donating to a crowdfunding campaign or similar social media fundraiser.

- Campaigning for a peer-to-peer fundraiser or giving through a friend’s fundraising page.

- Contributing physical goods to an in-kind donation drive.

- Attending a fundraising event, possibly with a holiday theme to capture the spirit of the season.

- Joining your recurring giving program so their contributions can continue into the new year.

Corporate Philanthropy

Donors’ employers may also be eager to support the causes their staff members care about at year-end. Research the companies your supporters work for to see if they offer any of these programs:

- Matching gifts to double their employees’ monetary gifts without asking them to give more out of pocket.

- Volunteer grants to turn the time volunteers contribute to your mission into money.

- Sponsorships to offset the upfront costs of fundraising events.

- Other workplace giving initiatives like team fundraising challenges or payroll deductions.

Earned Income

If your nonprofit has a membership program, December is a great time to promote it so you can secure renewals and encourage new first-time signups going into the new year. Some other ways your organization can legally generate its own income at the end of the year include:

- Selling branded merchandise like clothing, drinkware, and magnets.

- Launching product fundraisers, especially those featuring holiday-related items like wrapping paper and cookie dough.

- Leveraging supporters’ holiday shopping through gift card fundraisers or rounding-up programs at popular retailers.

- Running promotions on fees for mission-related services—for instance, an animal shelter might discount pet adoption costs in December, or a museum could rent out its event spaces at a reduced rate to other nonprofits for their year-end galas and auctions.

Investments & Grants

Since these revenue streams have a long-term focus, they likely won’t play a major role in your year-end fundraising efforts. However, you should take some time to ensure everything is in order for next year by:

- Reviewing your existing investments to see if you want to make any adjustments to your portfolio.

- Creating a calendar that shows when you’ll apply for new grants and complete essential grant management steps for existing ones.

- Using marketing grants to offset some costs of promoting year-end giving opportunities.

Focus on Donor Retention

As of the end of 2024, the average year-over-year donor retention rate across the nonprofit sector was 42.9%. So, if 100 donors contributed to your organization last year, 43 of them would give again this year—if you were lucky.

The end of the year is a critical time for donor retention for a few reasons:

- Cost effectiveness. On average, nonprofits spend $1.50 per dollar raised to acquire a new donor, but just $0.20 per dollar raised to retain an existing one. Retaining donors allows you to reduce upfront costs for your year-end giving campaigns and put more of your hard-earned resources toward your mission.

- Annual giving habits. While some supporters stay involved with your nonprofit between their year-end donations (whether through monetary donations or other types of support like volunteering or event attendance), you’ll hear from other donors just once a year—in December. So, it’s essential to remind them about their year-end gift to re-engage them and maintain that relationship.

- Reliable support. By retaining year-end donors, you’ll build a stable support base for your organization that will carry you into the next year and beyond. This is especially true if you can get supporters to sign up for your monthly giving program or membership program.

Although your nonprofit will likely want to acquire some new donors during its year-end campaign to fuel growth, you should prioritize retention to manage your resources effectively. If you haven’t reached the 42.9% year-over-year benchmark yet, work toward that goal first and improve from there.

Communicate Year-End Giving Impact

Given that the overwhelming majority of donors give at year-end to make a difference for a cause that matters to them, communicating impact is essential for retention and acquisition. Your marketing, fundraising, and appreciation materials should all emphasize the key role year-end donors play in helping your nonprofit further its mission.

Consider communicating impact to donors through:

- Images. Use charts, tables, and graphs to make complex concepts easier to understand and show progress. Photos of your beneficiaries receiving services or your volunteers hard at work also put a face to your mission and allow supporters to visualize what their gifts are doing in the community. (Just remember to obtain consent before publicly sharing anyone’s pictures or names!)

- Storytelling. Real-life impact stories help donors connect emotionally with the work their gifts have accomplished. Make sure to tell your nonprofit’s stories as they actually happened and include relevant firsthand perspectives from staff members, supporters, and beneficiaries to build trust with your audience.

- Data. Statistics make your organization’s impact more concrete, and they ground images and stories in reality—as long as you’re transparent with supporters no matter the results. If you achieved your goals, genuinely thank them and follow through on your promises for how you’ll use their resources to further your mission. If not, explain why you think the shortfall happened, explain your plans to improve your results, and encourage supporters to help you accomplish more in the future.

Year-end financial reporting is another critical element of communicating impact. Although you have to comply with specific requirements and your audience includes government agencies and other stakeholders, you’re still demonstrating your organization’s commitment to using its resources wisely to fulfill its mission. Plus, some year-end campaign donors may look at your most recent annual report’s financial charts and graphs—if not your financial statements and past Form 990s—to decide if they want to contribute.

Leverage Outsourced Services

To effectively manage all of your nonprofit’s year-end activities, you may need some additional help beyond your existing team’s bandwidth. However, you might not have enough work for another staff member to take on year-round. Plus, hiring and onboarding are expensive and time-consuming.

Fortunately, you have the option to outsource some end-of-year tasks to external professionals instead of hiring new employees. For example, you might work with:

- Fundraising consultants to assist with campaign strategy and strategic planning.

- Marketing and design professionals to update your website and create other promotional materials for year-end giving.

- Information technology experts to set up and maintain various types of software, from your donor database to event planning tools.

- Financial management firms to work through all necessary fiscal year-end tasks accurately and strategically.

If you’re looking for any type of outsourced nonprofit financial services (bookkeeping, accounting, fractional CFO, or part-time controller), look no further than Jitasa! We provide affordable, tailored services for a flat monthly rate, so you can partner with us through the year-end busy season or all year round. Plus, we only work with nonprofits, so our experienced team understands your organization’s unique needs and will collaborate with you to ensure effective financial management and alignment with your fundraising efforts.

Year-end fundraising and financial management can feel overwhelming for any nonprofit. But by developing an integrated strategy, you’ll set your organization up to achieve its goals in both. Use the tips above to get started, and don’t hesitate to reach out to experts with any questions or issues—including our team at Jitasa for financial activities!

For more information on year-end financial management, check out these resources:

- Nonprofit Revenue Recognition: What It Is & Why It Matters. Discover best practices for recording and categorizing the revenue you bring in during year-end fundraising.

- GivingTuesday Best Practices to Align Fundraising & Finances. Dive deeper into how to create a financially savvy strategy for the day that kicks off the year-end giving season.

- 12+ Top Nonprofit Accounting Firms & How to Choose One. Explore our top picks for accounting firms to help you work through your nonprofit’s year-end financial to-do list.

Let Jitasa’s expert accountants handle year-end financial management so you can focus on your nonprofit’s fundraising success

Request a Quote