Statement of Functional Expenses: Ultimate Guide + Template

Tuesday, September 9, 2025 by Jon Osterburg

The core of nonprofit accounting is accountability. As you record and report financial activities, your goal should be to show supporters and stakeholders that you’re reinvesting all of the funds you receive into your organization to further its mission.

Financial statements (i.e., recurring reports that summarize your nonprofit’s financial data) are essential to this accountability-centered accounting approach. One statement that particularly focuses on transparent spending of supporter contributions is the statement of functional expenses. In this guide, you’ll learn all you need to know about this report, including:

- What is a statement of functional expenses?

- Categories of Functional Expenses for Nonprofits

- Purpose of the Statement of Functional Expenses

- Nonprofit Statement of Functional Expenses Template

Let’s get started with an overview of the statement of functional expenses and how it fits into your nonprofit’s financial reporting processes.

Partner with Jitasa to create, analyze, and apply your nonprofit’s statement of functional expenses.

Request a QuoteWhat is a statement of functional expenses?

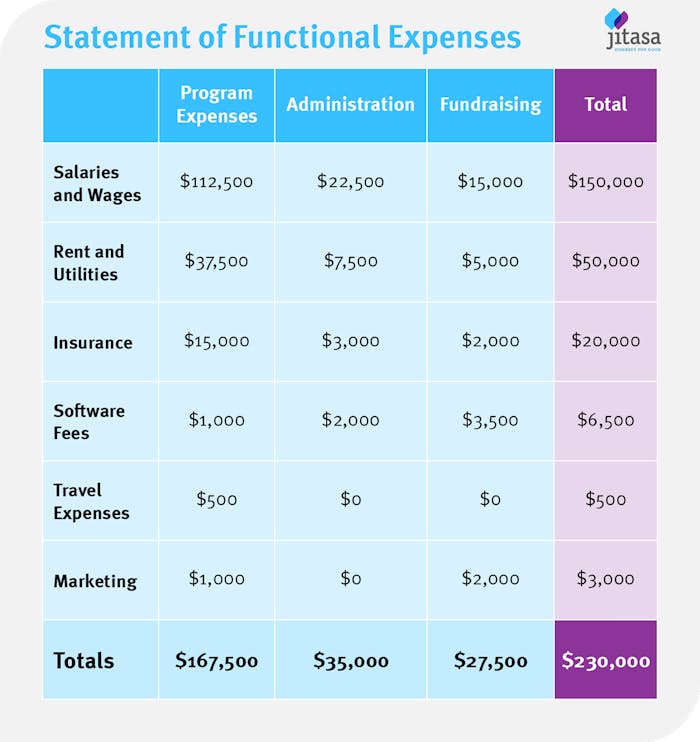

A statement of functional expenses is a table- or matrix-style report that categorizes nonprofit costs based on the purpose the money was used to accomplish. The table’s rows list various expenses as they’re recorded in your organization’s accounting system—based on the nature of payments made—and the columns organize costs according to their function in your mission-driven work (more on this distinction later!).

Here is an example of what a statement of functional expenses might look like:

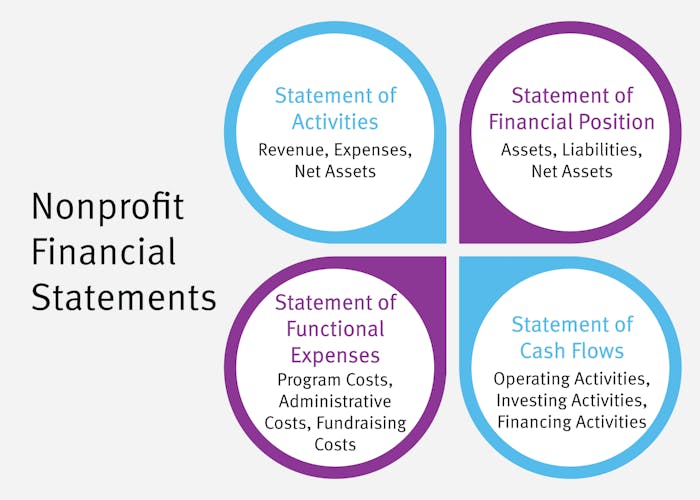

Other Nonprofit Financial Statements

The statement of functional expenses is one of four financial statements that all nonprofits should compile annually. The other three reports are the:

- Statement of activities, which categorizes your nonprofit’s revenue, expenses, and net assets to provide an overview of your annual transactions.

- Statement of financial position, which provides a snapshot of your nonprofit’s financial health by breaking down your assets, liabilities, and net assets.

- Statement of cash flows, which shows how money moves in and out of your organization through operating, investing, and financing activities.

While each of the above reports has a direct for-profit parallel—income statements, balance sheets, and cash flow statements, respectively—the statement of functional expenses is unique to nonprofits because it specifically focuses on how your finances further your mission.

Categories of Functional Expenses for Nonprofits

At this point, you might be thinking, “If my nonprofit already records spending based on the nature of payments made, why do we need to reorganize our expenses according to their end goal?” Generally speaking, functional expense categorization adds a layer of transparency that natural expense categories alone don’t provide, which helps maintain compliance and build trust with supporters.

With that in mind, let’s look at each of the three categories of functional expenses in more detail.

- Program expenses are directly related to your organization’s cause-driven efforts, so they vary widely from organization to organization. For example, an animal shelter would likely include spending on veterinary care supplies and pet food under its program expenses, while a nonprofit focused on children’s literacy might report purchases of books and other supplies for their student reading groups as program costs.

- Administrative expenses (sometimes called “management and general” costs) are necessary to operate your nonprofit day to day. These may include rent or mortgage payments, utility bills, insurance, office equipment purchases, and staff compensation, among other expenses.

- Fundraising expenses are the upfront costs associated with your nonprofit’s revenue-generating initiatives. Fundraising software subscriptions, event planning, marketing, and fundraising consulting fees are common costs that fall into this category.

You may also have heard the term “overhead expenses” in discussions of nonprofit finance, which refers to the administrative and fundraising categories of functional expenses combined. In the past, the general rule was that at least 65% of every nonprofit’s expenditures should be program-related and no more than 35% could go toward overhead. However, it’s now understood that every organization’s program-overhead spending breakdown will look different.

If your nonprofit is just getting started, you might have more overhead expenses as you secure a facility, launch and promote initial services, and acquire your first donors. Once your organization is better established, use the 65/35 “rule” as a general guideline to put as much revenue toward your programs as you reasonably can. If you determine that you need to cut costs, don’t take funding away from programming unless it’s absolutely necessary. Instead, start by finding small ways to reduce overhead, such as:

- Evaluating your software to ensure you’re getting the best value for your money out of every platform you use and adjusting subscriptions as needed.

- Requesting in-kind donations to cover event planning needs (e.g., auction items or catering services) so you don’t have to pay for those items out of pocket.

- Installing smart thermostats and low-flow bathroom fixtures at your facility to lower utility bills over time.

Overhead isn’t inherently bad—in fact, administrative and fundraising expenditures are integral to your nonprofit’s sustainability—but it also shouldn’t eclipse your mission-related work. After all, your programs are why most donors and funders support your organization in the first place!

Purpose of the Statement of Functional Expenses

Every nonprofit financial statement has three basic purposes:

- Compliance: Helping your organization meet external reporting requirements, whether they’re government-imposed or related to the Generally Accepted Accounting Principles (GAAP).

- Transparency: Providing donors, funders, board members, and the community at large with deeper insights into your nonprofit’s financial situation.

- Decision-making: Formatting financial data so it’s easier for your internal team to understand and act on.

The statement of functional expenses fulfills each of these purposes by being useful for:

- Tax filing. If your nonprofit is large enough to have to file the full Form 990, you’ll fill out a statement of functional expenses as part of your filing. Form 990-EZ (for midsize organizations), Form 990-PF (for private foundations), and some state tax forms include abbreviated expense reporting sections, and your internal functional expense report is a good reference for completing these documents.

- Annual reporting. Some of your nonprofit’s supporters likely want a detailed breakdown of your spending each year, while others are satisfied with a basic chart or graph in the financial section of your annual report. Refer to your statement of functional expenses to create that graph within the report, then attach the full statement as an appendix for donors who are interested in learning more.

- Budgeting. By comparing your organization’s actual expenses with your predictions in last year’s annual operating budget, you can make more accurate projections when allocating expenses for the coming year.

Compile your statement of functional expenses as soon as you close your books for the fiscal year. That way, it’ll be ready to go for your Form 990 and annual report in the first few months of the new year. You’ll probably need to work on your operating budget before this occurs, so you can use a combination of year-to-date expense information, cash flow forecasting, and any previous years’ functional expense reports you still have on hand to make data-driven cost projections.

Preserve essential financial data with our nonprofit record retention policy template.

Download for FreeNonprofit Statement of Functional Expenses Template

Every organization’s statement of functional expenses will look slightly different depending on what expenses you incur and how you allocate resources. However, the functional expense categories of program, administrative, and fundraising costs are consistent for all nonprofits.

Here is a basic template to help you start creating your nonprofit’s statement of functional expenses (making sure to modify it for your needs):

While this DIY approach can work if your organization’s finances are relatively simple, the best way to ensure your statement of functional expenses meets nonprofit reporting requirements and accurately represents your spending is to partner with expert financial professionals like our team at Jitasa. Our accountants work exclusively with nonprofits, so when you partner with us, we’ll use our experience to compile comprehensive reports and recommend ways to improve your financial practices based on our analysis of them!

Although your nonprofit’s statement of functional expenses is essential for compliance, analyzing it and applying the insights you glean to your expense allocation and budgeting procedures can provide even more value for your organization. Use the tips in this guide to get started, and don’t hesitate to reach out for professional assistance whenever you need it.

For more information on nonprofit financial reporting, check out these resources:

- Nonprofit Chart of Accounts: How to Get Started + Example. Explore the main resources your nonprofit’s statement of functional expenses should be based on: your chart of accounts.

- Nonprofit Form 990 Filing: FAQ Guide + How to Get Started. Dive deeper into the process of filing your nonprofit’s annual tax return, including how it also promotes accountability and transparency.

- Nonprofit Financial Management: Overview + Best Practices. Discover how functional expense reports and other financial statements fit into the bigger picture of nonprofit financial management.

Unlock more accurate financial reporting and effective expense allocation by partnering with Jitasa.

Request a Quote