Restricted Funds: Everything Your Nonprofit Needs to Know

Monday, June 16, 2025 by Boyd Orr

In a 2024 Give.org survey of nonprofit supporters, 67% of respondents said they think it’s essential to trust an organization before contributing to it. However, only 22% of respondents to the same survey highly trust nonprofits. From these numbers, it’s easy to see that there is a need for nonprofits like yours to build trust with donors, and effective financial management is a major aspect of this process.

One of the most challenging but important areas of nonprofit finance for increasing donor trust is properly handling restricted funds. In this guide, we’ll cover the basics of nonprofit funding restrictions, including:

By honoring supporters’ and funders’ restrictions on their gifts, you can demonstrate that you’re committed to fulfilling your promises and furthering your mission, making donors feel more confident in your nonprofit—and therefore more likely to give.

Properly manage restricted funds with expert help from Jitasa’s accounting team.

Request a QuoteRestricted Funds: Frequently Asked Questions

Since restricted funds can be confusing, especially if you haven’t handled this type of funding before, let’s begin by answering a few common questions about them.

What are restricted funds?

Restricted funds are nonprofit contributions that are earmarked for a specific purpose by the contributor. When making a gift, donors and funders have the legal right to choose designations for the funding they contribute to your nonprofit and require that their gifts be used only for their chosen initiative.

On the flip side of restricted funds are unrestricted funds, which are contributions with no designations attached. Your organization can decide what its greatest need is for those funds and allocate them as you see fit.

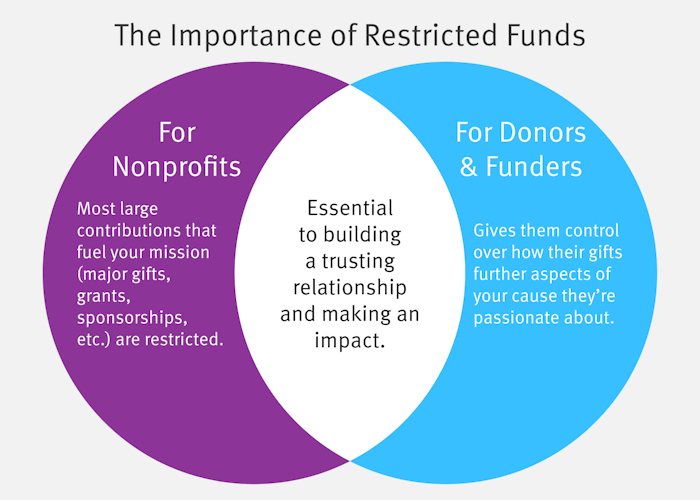

Why are restricted funds important?

Restricted funds are significant for both your nonprofit and its donors. (Not to mention the government—the IRS expects to see accurate reporting and proper usage of restricted funds on your annual tax return, which demonstrates that your organization prioritizes accountability in all aspects of its financial operations.)

For your nonprofit, restricted funds matter because most of your largest contributions likely come with designations. It’s estimated that 80% of individual donation revenue comes from the top 20% of nonprofit donors. Plus, other significant revenue sources like grants and fiscal sponsorships are vital to your organization’s success, and these contributions are frequently restricted as well.

Most large-dollar donors and funders want to understand exactly where their money is going before giving it away. So, for stakeholders, restricted funds give them control over how their contributions will further your mission. They’ll often put their gifts toward areas of your work they’re passionate about. For example, if a major donor to your environmental nonprofit highly values education and has served on their local school board, they might designate their gift for your initiative to teach K-12 students about recycling.

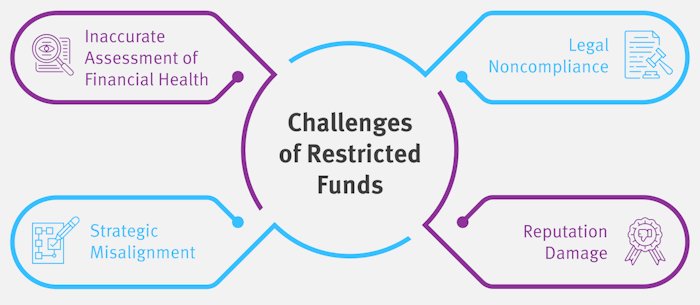

What risks are associated with funding restrictions?

Your nonprofit’s key stakeholders tend to take restricted funds very seriously, so you should, too. The reason restricted funds are so challenging is because there are several major risks associated with managing them incorrectly, including:

- Legal noncompliance. If the IRS discovers that your nonprofit hasn’t honored funding restrictions, you may face fines or even lose your tax-exempt status. Donors and funders who impose restrictions on contributions also reserve the right to sue your organization for misallocation of funds.

- Reputation damage. Improperly allocating restricted funds doesn’t just damage your nonprofit’s relationship with that one supporter—it can also make the rest of your community see your organization as untrustworthy.

- Inaccurate assessment of financial health. Failing to account for funding restrictions may give you the impression that you have more cash on hand to cover your nonprofit’s costs (especially overhead expenses, as very few donors designate gifts for these) than you actually do, skewing your budget and revenue goals.

- Strategic misalignment. Most restrictions are established during conversations between potential donors and staff members at your organization, or else are set forth by funders of grants your nonprofit chooses to apply for. If you don’t select grant opportunities carefully or allow donors to designate gifts in ways that don’t align with your nonprofit’s strategic plan, these funds will start to hinder your goals rather than help them.

While these risks are real and can be detrimental to your nonprofit, it is possible to manage and mitigate them. Ensure everyone at your organization is well educated about funding restrictions and is committed to pushing your current priorities forward through solid financial management so they can seek out and handle restricted contributions properly.

Dive deeper into restricted funds with our free course!

Sign UpTypes of Nonprofit Funding Restrictions

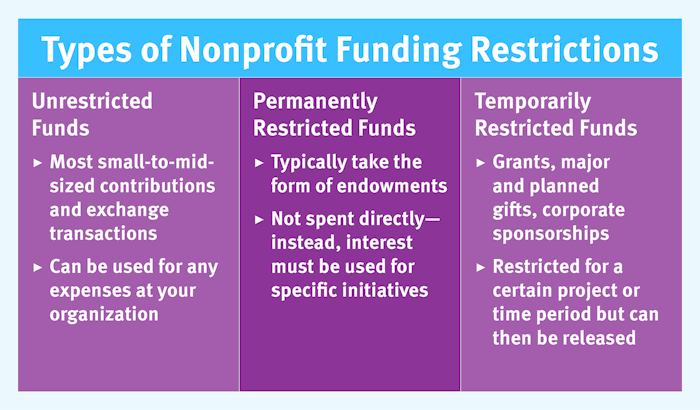

Not all funding your nonprofit receives will be restricted in the same ways. Here is a breakdown of the three major categories of nonprofit funds (sometimes also referred to as categories of nonprofit net assets) according to how your organization should track them in a fund accounting system.

Unrestricted Funds

As mentioned previously, unrestricted funds have no designations, so you can put them toward any expenses listed in your nonprofit’s budget, including:

- Administrative costs like staff compensation, utility bills, rent or mortgage payments on your facility, insurance, office equipment purchases, and any other costs necessary to operate your organization day-to-day.

- Fundraising costs such as event planning, marketing, merchandise creation, consulting fees, software subscriptions, and other upfront spending on revenue-generating campaigns. Fundraising and administrative costs together make up your nonprofit’s overhead.

- Program costs that aren’t fully funded by restricted contributions. For example, if you need $50,000 to launch a new program and you have a $25,000 grant and a $20,000 major gift designated for that program, you can use unrestricted funding to cover the remaining $5,000.

Many types of nonprofit contributions are typically unrestricted, including:

- Most small to mid-sized individual donations

- Some types of corporate giving, like matching gifts and volunteer grants

- Most investment returns, such as interest earned via brokerage accounts

- Exchange transactions, which are contributions made with the expectation that the donor will receive something in return, like a piece of merchandise or admission to an event

Only donor-imposed funding designations are legally binding and therefore considered restrictions. However, if you launch a fundraiser and tell donors that all of the revenue from that campaign or event will go toward a specific initiative, it’s in your best interest to follow through on your promise to build trust with those supporters.

Permanently Restricted Funds

Permanently restricted funds typically take the form of endowments. Your nonprofit isn’t allowed to spend these funds directly. Instead, you’ll put them in an investment account and use the interest they generate to fund an ongoing, donor-designated initiative.

Endowment funds are most common among universities and cultural organizations, which use them to support scholarships, research, and other long-term funding needs. However, any nonprofit can start an endowment account and solicit contributions for it to future-proof high-priority areas of their mission.

Temporarily Restricted Funds

Temporarily restricted funds are typically bound by a time limit or a specific purpose. If that time expires or the purpose is fulfilled and there is still money available, you may be able to release the leftover funds from restriction, depending on your agreement with the donor or funder. Some contributors may want the extra money back or have another project in mind to designate it for, but donation agreements where surplus funding becomes unrestricted revenue after the initial conditions are met tend to be the most beneficial for your organization.

The most common types of temporarily restricted funds include:

- Major and planned gifts from individual donors

- Grants provided by government agencies and foundations

- Corporate sponsorships—the one commonly restricted type of exchange transaction (since companies enter into sponsorship agreements with the expectation of receiving free publicity in return for financial support) and the type of restricted funding most often linked to overhead costs (because sponsorship funding is often designated for events)

To see how temporary restrictions work in practice, let’s say your nonprofit launches a capital campaign to renovate your facility, and a major donor contributes $50,000 to the project. The renovations are completed under budget, so you only end up using $48,000 of this donor’s gift. With the donor’s permission, you can release the remaining $2,000 from restriction and allocate it to other areas of your budget, such as hosting your first event at the upgraded facility or paying its future utility bills there.

Temporarily Restricted Funds vs. Deferred Revenue

Temporarily restricted funds are sometimes confused with deferred revenue. Although both terms describe revenue your organization isn’t allowed to freely spend upon receiving it, they’re accounted for separately.

Deferred revenue refers to funding your organization has received but isn’t yet allowed to recognize as income in your accounting system. This occurs when the agreement between your nonprofit and the donor is conditional upon your organization providing goods or services to the donor. Until you deliver what you’ve promised, deferred revenue is considered a liability in your records and reports.

By contrast, the donor’s conditions for temporarily restricted funds are related to how you’ll use the funding. You can record the contribution as income as soon as you receive it, and you’ll treat it as an asset from the beginning.

For example, let’s say a science museum offers week-long summer day camps for elementary-age kids. To make planning easier for staff and families, signups open in February each year. Although parents pay the participation fee at the time of registration, the organization can’t recognize those fees as revenue until they provide the parents the promised service of a week of camp for their children. Therefore, these advance registration fees are considered deferred revenue.

How to Manage Restricted Funds

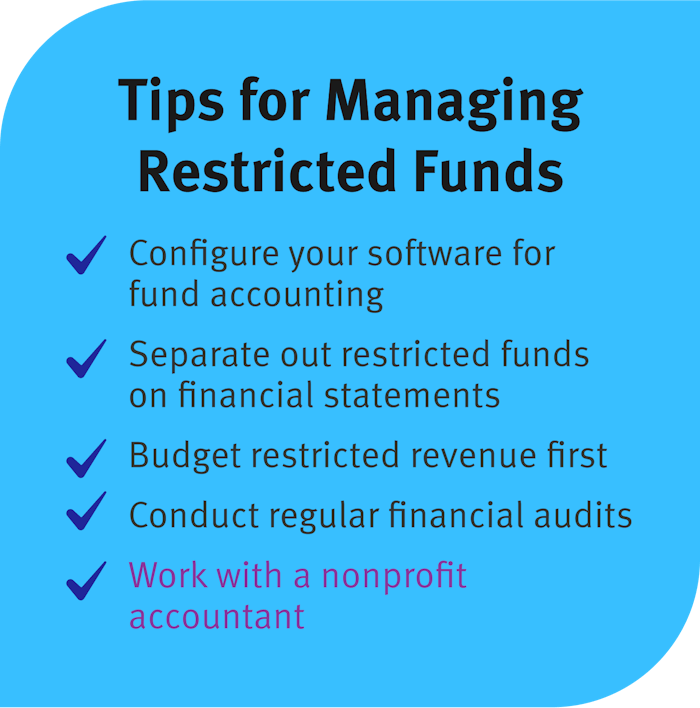

Now that you understand the basics of restricted funds, here are a few additional tips for managing them effectively at your nonprofit:

- Configure your software for fund accounting. While there are accounting platforms built specifically for nonprofits, three of the most popular solutions—QuickBooks Online, Intuit Enterprise Suite, and Sage Intacct—are designed primarily for business accounting. However, all of these platforms can be customized for nonprofit use, so familiarize yourself with their settings and implement separate tracking for various types of restricted funds when you set up your software.

- Separate out restricted funds on financial statements. Your statements of activities and financial position both track your nonprofit’s net assets. Separating your net assets with and without donor restrictions in these reports will help you analyze your financial data and fill out your tax returns more accurately. Plus, it’s common to attach your financial statements to your annual report so interested stakeholders can dig deeper into your finances, including restricted funds.

- Budget restricted revenue first. When you create your annual operating budget, start by noting what restricted revenue you’ve received and allocating it toward the initiatives it’s designated for. This way, you’ll know how much unrestricted funding you need to fill in the gaps and avoid misappropriating funds.

- Conduct regular financial audits. An independent financial audit provides an external, objective perspective on your nonprofit’s finances so you can improve your management practices. Your auditor will point out if there are any issues with your existing procedures around restricted funds and help you identify opportunities to more effectively align them with your strategic plan.

The best way to ensure you’re handling restricted funds properly and making the most of them is to work with a nonprofit accountant, like our team at Jitasa. With our years of experience working exclusively with organizations like yours, we’ve seen nearly any situation you could think of related to funding restrictions, and we can use this expertise to create tailored solutions for your nonprofit. No matter your organization’s size, vertical, or funding mix, we’re here to help.

Restricted funds may seem challenging to handle at first, and it’s critical to keep track of them for compliance purposes. With a strong understanding of basics and best practices on your side (along with an experienced accountant!), you’ll be well on your way to honoring your promises to donors, grantmakers, and sponsors and establishing a reputation as a trustworthy nonprofit.

For more information on funding restrictions and their impact on nonprofit accounting, check out these resources:

- Nonprofit Revenue Recognition: What It Is & Why It Matters. Dive deeper into key terms and concepts associated with revenue recognition, including restricted net assets, deferred revenue, exchange transactions, and more.

- Grant Management: How to Secure and Track Nonprofit Funding. Learn more about every stage of managing a common type of restricted revenue—grants—from application to reporting.

- 12+ Top Nonprofit Accounting Firms & How to Choose One. Explore the best options for an outsourced nonprofit accountant to help you navigate restricted fund tracking, budgeting, accounting system setup, and other essential tasks.

Partner with Jitasa to correctly track and honor funding restrictions for compliance and donor trust.

Request a Quote