Nonprofit Statement of Financial Position: Guide + Template

Friday, May 16, 2025 by Jon Osterburg

For your nonprofit to expand its operations and make a greater impact over time, it needs to be financially healthy and sustainable. There are several nonprofit accounting resources you can use to assess your financial situation with regard to growth potential, and one of the best is your statement of financial position.

While your organization is required to compile a statement of financial position each year for compliance purposes, it’s also extremely useful for decision-making. In this guide, you’ll learn all you need to know about this report, including:

- What is the Nonprofit Statement of Financial Position?

- Statement of Financial Position vs. Balance Sheet

- Core Balance Sheet Sections

- Statement of Financial Position Applications

- Nonprofit Statement of Financial Position Template

Before we explore how you can use your statement of financial position to make more informed decisions for your organization, let’s review what this report is and its role in the greater landscape of nonprofit accounting.

Partner with the nonprofit accountants at Jitasa to create and interpret your statement of financial position.

Request a QuoteWhat is the Nonprofit Statement of Financial Position?

The nonprofit statement of financial position is a report that provides a snapshot of your nonprofit’s financial health. It summarizes key data in your organization’s accounting system so you can analyze it more easily and draw actionable conclusions.

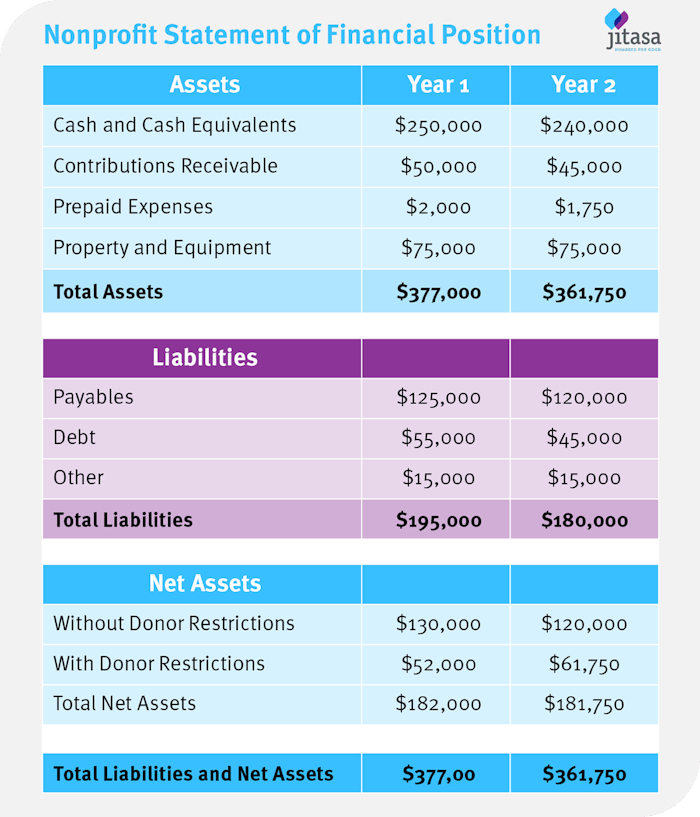

The statement of financial position covers your nonprofit’s assets, liabilities, and net assets (more on each of these sections later!). Most organizations compile this report annually, and many include year-over-year comparisons to allow for more granular analysis. When you put all of this information together, the completed report looks something like this:

Statement of Financial Position vs. Balance Sheet

Especially if you worked for a for-profit organization before moving to the nonprofit sector, you might have heard the term “balance sheet” used to describe a report detailing assets and liabilities. This is because “statement of financial position” and “balance sheet” are two different terms that refer to the same report.

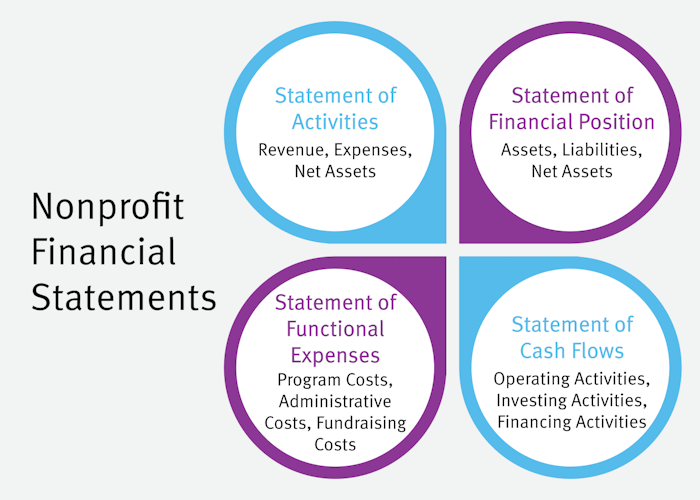

Which one your nonprofit uses internally is up to you, but you should be aware of both terms because reporting organizations may ask for the statement by either name. Generally speaking, for-profit organizations often prefer the more traditional term “balance sheet,” while nonprofits tend to use “statement of financial position” to align with the names of their other core financial statements, which include the:

- Statement of activities. As the nonprofit parallel to the for-profit income statement, this report summarizes your organization’s annual revenue, expenses, and net assets.

- Statement of cash flows. This statement, which is typically compiled monthly and referred to the same way by for-profit and nonprofit organizations, shows how money moves in and out of your nonprofit through operating, investing, and financing activities.

- Statement of functional expenses. The one financial statement unique to nonprofits, this report categorizes your organization’s expenditures based on how each one furthers your mission (programs, administrative activities, or fundraising).

Each of these statements is critical to gain different insights into your organization’s financial situation and promote accountability with supporters, stakeholders, and the government.

Core Balance Sheet Sections

The sections of your nonprofit’s statement of financial position correspond to three of the five divisions of your chart of accounts (COA), which is essentially a directory of your organization’s financial records. This makes it easier for your accountant to pull the data and for your team to refer back to the source for more detailed information as needed. For now, here is an overview of each section as it appears in the report.

Assets

The assets section of your balance sheet outlines what your nonprofit owns. Depending on your organization’s situation, the line items in this section might include:

- Cash funds

- Investments

- Accounts receivable

- Prepaid expenses

- Property and equipment

Most organizations report their assets in order of liquidity—i.e., how easy it would be to turn them into cash if necessary. Therefore, cash is typically at the top of the list because it’s already liquid, and property and equipment are at the bottom because you’d have to sell them for them to become liquid.

Liabilities

The liabilities category details what your nonprofit owes. Some potential subcategories for this section include:

- Loans and other debt

- Deferred revenue

- Accounts payable

- Unpaid expenses

- Certain elements of employee compensation, such as accrued vacation time and pensions

The order of liabilities on your statement of financial position depends on their due date, with short-term obligations listed before long-term ones. For example, you’d likely put deferred revenue from advance registrations for an event that will happen two months from now close to the top of the list and the 10-year mortgage on your nonprofit’s new facility near the bottom.

Net Assets

Your net assets (or equity) describe what your nonprofit is worth. They’re calculated by subtracting your total liabilities from your total assets, which should be listed in the other two sections of your balance sheet.

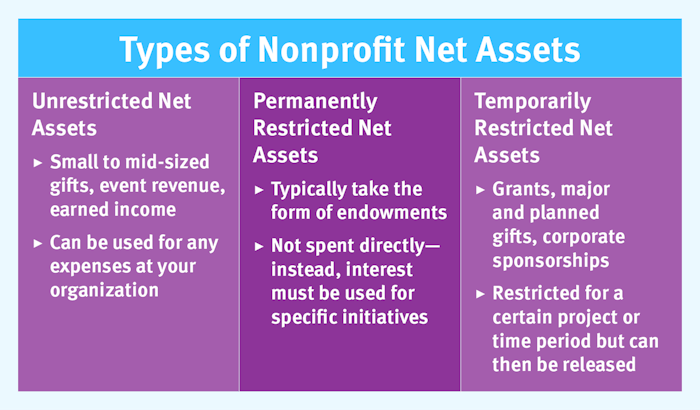

Then, you’ll categorize your net assets according to whether there are specific requirements for how to use them. Here is a quick breakdown of how these restrictions work:

- Unrestricted net assets aren’t designated for any specific purpose, so your nonprofit can put these funds toward any area of its budget. Most small to mid-sized individual donations, event revenue, and earned income (membership dues, merchandise sales, etc.) are considered unrestricted net assets.

- Permanently restricted net assets typically take the form of endowments, which your nonprofit isn’t allowed to spend directly. Instead, you’ll place the funds in an investment account and use the interest they generate to pay for a donor-designated initiative.

- Temporarily restricted net assets include most major and planned gifts, grants, and corporate sponsorship revenue. These funds come with donor designations that depend on a specific project or agreed-upon time period. Once the project is finished or the time period elapses, any leftover funding is released from restriction.

Your net assets are essentially the resources (which may or may not be monetary) you have available to fund your operations and mission-related activities. Separating out restricted and unrestricted net assets gives you a more detailed perspective on how much you can put toward each initiative and overhead expense you need to pay for.

Statement of Financial Position Applications

Now that you know the general purpose of your nonprofit’s statement of financial position and the data included in it, let’s discuss a few ways this report can be useful to your organization’s financial management activities and operations at large.

Calculating Cash on Hand

There are two equations you can use to gain the aforementioned insights into how much funding you have available to cover your nonprofit’s expenses—particularly the administrative and fundraising costs that make up your overhead—from the data on your balance sheet.

The simpler of the two calculates your organization’s months of cash on hand, which you can figure out by dividing your total cash and cash equivalents (e.g., most low-risk investment vehicles like treasury bills and money market mutual funds) by your average monthly expenses. Try to have three to six months of cash on hand at any given time, aiming for the upper end of that range if you’re planning for growth and the lower end if you just want to be prepared for emergencies and achieve stability.

The other equation calculates your nonprofit’s months of liquid unrestricted net assets (LUNA), which is a bit more complicated but also more accurate because it takes restricted funds into account. Follow these steps to determine months of LUNA:

- Find the total value of your nonprofit’s property and equipment in the assets section of your statement of financial position.

- Subtract that number from your organization’s total unrestricted net assets.

- Divide the result by your average monthly expenses.

Because this calculation is more precise, nonprofit accountants recommend having exactly three months of LUNA to achieve financial stability and just slightly more if you’re planning for growth. A positive value of less than three months of LUNA isn’t an immediate concern (although a negative one is, because that means your nonprofit is spending more than it brings in every month), but it’s something to keep an eye on and try to improve in the near future.

Informing Strategic Planning

Determining that your nonprofit has the cash on hand to grow is the first step in applying your statement of financial position to strategic planning. You can also use the data to evaluate:

- Your organization’s current trajectory for expansion and financial health (which is why year-over-year comparisons are so helpful).

- What total and net assets you can increase to help fund your growth, such as applying for more grants or investing your reserve funds more efficiently.

- What new liabilities and calculated risks you’re willing to take on—for example, getting a new loan to finance a facility renovation and launching a capital campaign to pay it off.

Along with your other financial statements and the more granular data in your accounting software, your balance sheet can also be helpful for goal-setting and progress tracking over multiple years of carrying out a strategic plan.

Maintaining Compliance

The most straightforward reason your organization should compile a statement of financial position each year is to comply with various nonprofit regulations. The main areas of compliance that this report applies to include:

- Aligning with the Generally Accepted Accounting Principles (GAAP): This set of guidelines was developed collaboratively by several financial oversight institutions to standardize recordkeeping and reporting for all for-profit and nonprofit organizations, including requiring every organization to create an annual balance sheet.

- Filing Form 990 with the IRS: Although your nonprofit is exempt from federal income tax, you still have to complete an annual tax return using data from your balance sheet and other financial statements to maintain that status.

- Undergoing independent financial audits: All of your financial statements will likely be on the list of documents your auditor asks you to pull, but they’ll typically pay special attention to your statement of financial position so they can make stronger health and sustainability-related recommendations.

Another related application that isn’t technically required—but is strongly recommended!—is incorporating your statement of financial position into your nonprofit’s annual report. Many organizations report some high-level financial data in the report itself, using charts and graphs to make it easier to understand. Then, they’ll attach their complete financial statements as appendices in case some readers want to dig deeper.

Set guidelines for creating and distributing financial statements with our Nonprofit Financial Reporting Policy Template.

Download for FreeNonprofit Statement of Financial Position Template

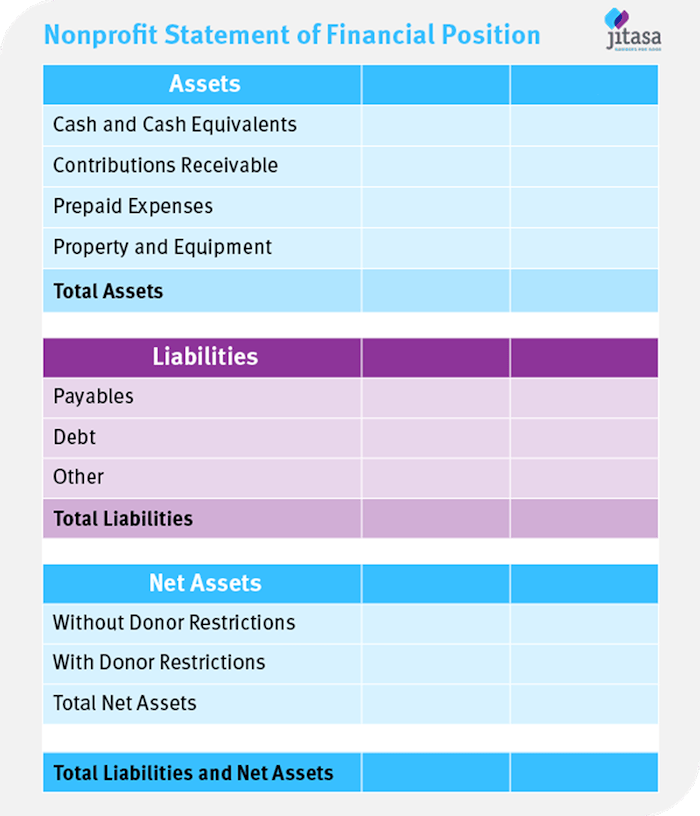

To help you get started with creating your nonprofit’s statement of financial position, here is a blank template you can fill in:

While online templates like this one can be helpful, the best way to create an accurate, useful statement of financial position is to work with nonprofit accounting professionals like our team at Jitasa. Our services are designed exclusively for nonprofits, so we have lots of experience compiling balance sheets for organizations like yours. We’re also happy to help you apply the data in this report through audit preparation, tax filing, financial goal analysis, and various other activities to help your nonprofit achieve financial health and sustainability.

The statement of financial position plays many key roles in your nonprofit’s accounting activities and operations, so it’s important to create and analyze it accurately. Use the information and tips above to get started, and don’t hesitate to reach out to an accountant if you have any questions or need help along the way.

For more information on nonprofit financial health and reporting, check out these resources:

- What Is Fund Accounting? A Guide to Basics & Best Practices. Dive deeper into the recordkeeping system that forms the foundation of nonprofit balance sheets, particularly the distinction between restricted and unrestricted net assets.

- How to Set up QuickBooks for Nonprofits: The Complete Guide. Learn how to configure the leading accounting solution on the market, QuickBooks Online, to accurately collect data for, compile, and store your nonprofit’s statements of financial position.

- Free Nonprofit Assessments by Jitasa. Test your knowledge of nonprofit finance and systematically consider your organization’s overall health to supplement the insights from your balance sheet.

Let the experts take care of compiling, analyzing, and applying your statement of financial position by working with Jitasa.

Request a Quote