Nonprofit Financial Statements: 4 Essential Reports to Know

Wednesday, October 4, 2023 by Jon Osterburg

If your nonprofit has a solid accounting system in place, you likely collect a lot of financial data. However, this data is only useful in helping your organization improve its operations if you can effectively analyze it and draw applicable conclusions.

This is where financial statements come into play. Each of the four core reports that nonprofits compile annually summarizes your financial data in a different way, providing unique insights into your organization’s current situation.

In addition to being a helpful management tool, your financial statements are also essential to maintaining compliance with reporting requirements for tax-exempt organizations. They help hold your nonprofit accountable for its use of resources, ensuring you can maintain your 501(c)(3) status.

In this guide, we’ll walk through the basics of the nonprofit financial statements, including:

- Why are financial statements important for nonprofits?

- The 4 Major Nonprofit Financial Statements

- How to Create Financial Statements for Your Nonprofit

There are some parallels between nonprofits’ financial statements and those of for-profit organizations—systematic reporting is an important part of complying with the Generally Accepted Accounting Principles (GAAP). However, your organization’s reports will also look different in certain ways because nonprofits are subject to requirements that businesses aren’t. If you need help creating your financial statements, reach out to an accountant who has experience working with nonprofits to ensure you get access to specialized expertise.

Contact the experts at Jitasa to compile your nonprofit financial statements.

Request a QuoteWhy are financial statements important for nonprofits?

While the most obvious benefit of compiling nonprofit financial statements is complying with government regulations and GAAP standards, these reports also provide an overview of your organization’s financial health. With this knowledge, you can:

- Make data-driven decisions in the short term. These decisions can range from how your nonprofit should generate revenue during the coming year to when to launch certain projects and programs in order to allocate resources most effectively.

- Develop a long-term strategic plan for your organization. Your financial situation is a major factor in determining if and how much your nonprofit can grow, so it should influence your overarching goals and the way you conduct multi-year initiatives.

- Improve your risk management strategy. Having a detailed but understandable summary of your nonprofit’s finances can help you identify potential financial risks and develop effective methods to prevent or mitigate them.

- Be more transparent with supporters. By publicizing your financial statements in your nonprofit’s annual report, you can make clear to donors that you are using their contributions to further your mission. This helps them to be more confident in your organization and therefore more likely to continue supporting you over time.

At its core, nonprofit accounting is about accountability. Financial statements function as an organized system for reporting on your nonprofit’s resources, so your organization is regularly held accountable to itself, its supporters, and its community. Consider developing a financial reporting policy to provide an official reference for how your organization will create and distribute each of the four major statements in a way that maximizes transparency.

Nonprofit Financial Reporting Policy Template

Download for FreeThe 4 Major Nonprofit Financial Statements

Although there are countless ways to organize your nonprofit’s financial information, most organizations compile four main types of reports. Since each of these core financial statements provides a different way to visualize the data you’ve collected, you can glean unique insights about your organization’s financial health from all of them. Let’s walk through the structure and purpose of each of these four reports in more detail.

1. Statement of Activities

The statement of activities is the nonprofit parallel to the for-profit income statement. Its purpose is to provide detailed information about your organization’s transactions, showing how your expense allocation and revenue generation further your mission.

This statement is divided into three main sections:

- Revenue. This section is further broken down into your nonprofit’s various funding sources, such as individual donations (both financial and in-kind), grants, earned income such as membership dues or fees charged for services provided, and investment returns.

- Expenses. Rather than organizing costs based on the nature of the payment made, nonprofits typically break down the expense section of this report based on the function of each cost as it relates to furthering their mission. Functional expenses will be covered in more detail later, but the three categories to know are program, administrative, and fundraising costs.

- Net Assets. To calculate your organization’s net assets, simply subtract your total expenses from your total revenue. Most nonprofits also include their net assets at the beginning of the fiscal year in a separate row so they can compare that number to their change in net assets during the year.

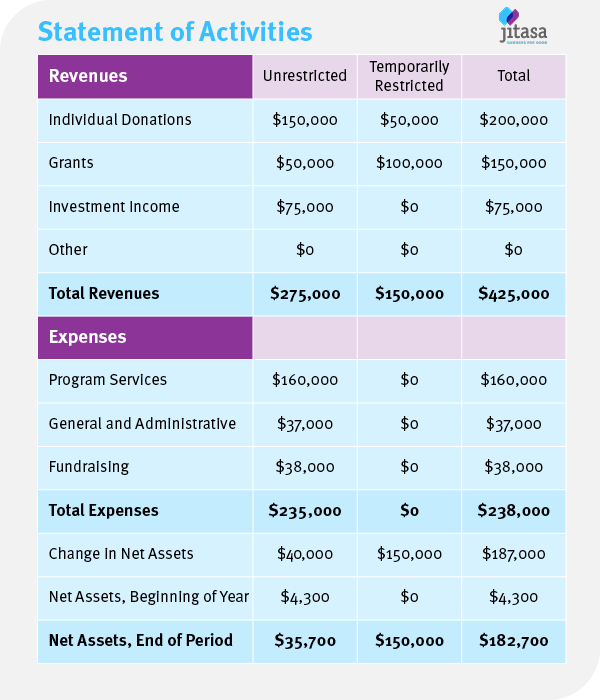

When you combine these sections into a single report, your nonprofit statement of activities should look something like this:

Not only is the revenue section broken down into categories by funding source in this example, but a distinction is also made between unrestricted and restricted funds. Your nonprofit is required to use restricted funds for a specific purpose, usually based on an agreement made with the major donor or grantmaker who provided the funding. Meanwhile, unrestricted funds can be allocated toward any type of expense. This distinction allows you to understand how flexible your nonprofit’s funding is in addition to how much you have.

Additionally, the line items in your organization’s statement of activities should match those in the operating budget you created at the beginning of the fiscal year. By comparing these two documents, you can evaluate your planned versus actual expenses and revenue generation. Then, you can reference your statement of activities to make more accurate predictions when you develop a new operating budget for the coming year.

2. Statement of Financial Position

The nonprofit statement of financial position is also known as a balance sheet, which is what for-profit organizations usually call their equivalent statement. It provides a snapshot of your organization’s financial health, meaning it plays an especially important role in nonprofit financial audits.

Similar to the statement of activities, the balance sheet also has three main sections:

- Assets. This section describes everything your nonprofit owns, such as cash, accounts receivable, prepaid expenses, property, and equipment. From top to bottom, these categories are listed in order of liquidity—i.e., how easy they are to convert into cash. Cash comes first because it’s already liquid, and property and equipment come last because your organization would have to sell them for them to become liquid.

- Liabilities. This term refers to everything your nonprofit owes, including accounts payable, debt, lease obligations, and any other deferred payments. These are usually organized by due date. For example, invoices from vendors that you’ll repay within the year would be listed above larger debts that will take multiple years to pay back.

- Net Assets. Subtract your total liabilities from your total assets to calculate your net assets for your statement of financial position. Make sure to separate restricted net assets from unrestricted ones on this report as well.

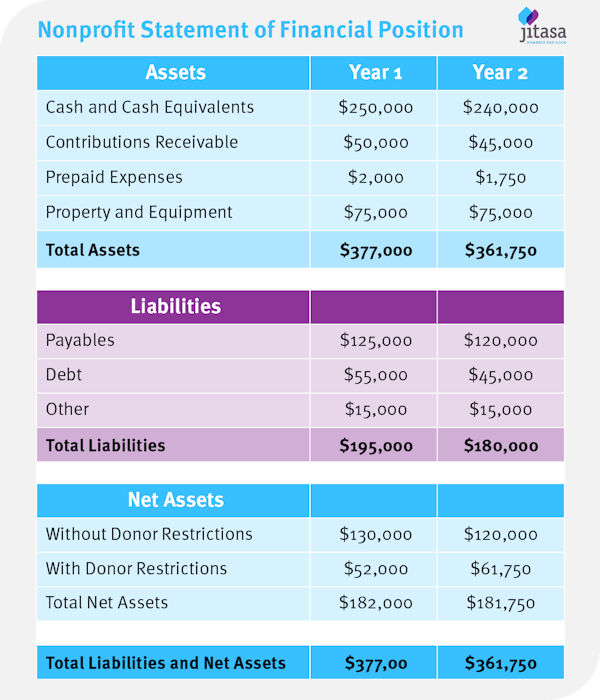

With all of the different assets and liabilities your nonprofit might have, your statement of financial position can quickly become complex. However, to give you an idea of what this report could look like, here is a basic example:

Note that this example contains information from two different years: the current fiscal year and the previous year. This allows you to compare your assets and liabilities year over year to see whether your financial health is improving over time.

This statement can also help your nonprofit plan for growth. If you want to expand your organization, you’ll need to have enough cash on hand to cover your usual operating costs and take on additional expenses. The data in your balance sheet can help you figure out the total amount of cash and other liquid assets you have available so you can determine whether your nonprofit has enough financial flexibility to grow.

3. Statement of Cash Flows

Both for-profit and nonprofit organizations use the term “statement of cash flows,” and the report it describes looks fairly similar between the two. This statement shows how cash moves in and out of your organization on a regular basis, so it’s usually pulled monthly, rather than annually like the other three core statements.

This report shows your organization’s cash flows as they relate to:

- Operating activities. This section encompasses the revenue and expenses associated with most of your nonprofit’s day-to-day activities, including fundraising, contracting, and employee salary payments.

- Investing activities. This information is related to your nonprofit’s long-term assets. For example, if you purchase new office equipment or open a brokerage account that earns interest, those would fall under investing activities.

- Financing activities. This section covers your nonprofit’s long-term liabilities, such as the borrowing and repayment of debts and the establishment of endowment funds.

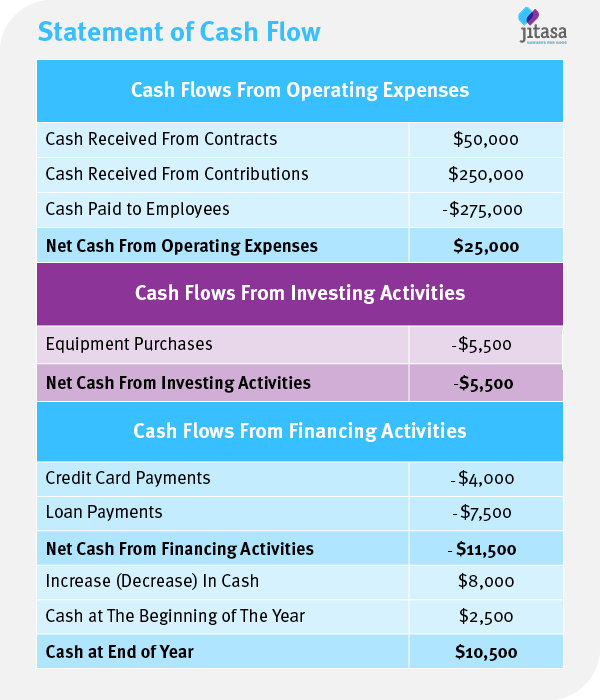

On a basic level, a nonprofit statement of cash flows looks like this:

In addition to the net cash flows from each of the three types of activities, this example includes a summary section comparing the organization’s increase in cash during the month to the amount they already had on hand. This information aligns with the main purpose of a cash flow statement: monitoring your organization’s spending and fundraising from month to month. When you know this information, you can more effectively stay on track with your budget throughout the year and ensure you don’t accidentally overdraft any of your nonprofit’s accounts.

4. Statement of Functional Expenses

The last of the four essential financial statements, the statement of functional expenses, is unique to nonprofits. In most accounting systems, expenditures are typically recorded as natural expenses, which are based on the nature of the payment. Most for-profit organizations stop there, but nonprofits have to go one step further and reorganize their costs based on their function in furthering the organization’s mission, which are known as functional expenses.

The statement of functional expenses is a matrix-style report with natural expense categories listed on the horizontal axis and functional expense categories on the vertical axis. While the natural expenses included in this statement will vary by organization, the three standard categories of functional expenses are:

- Program costs. These are also unique to each nonprofit based on its mission, but the term refers to any directly cause-related expenses. For example, an environmental conservation organization would include the costs of hosting educational workshops on natural resource protection and coordinating beach cleanup days in their program expenses.

- Administrative costs. These expenses are necessary to keep your organization running day to day. They include staff compensation, rent, utilities, and office supplies, among other expenditures.

- Fundraising costs. Bringing in revenue for your nonprofit usually comes with upfront expenses. Spending on event planning, marketing, software to run your campaigns, and fundraising consultant fees would all fall into this category.

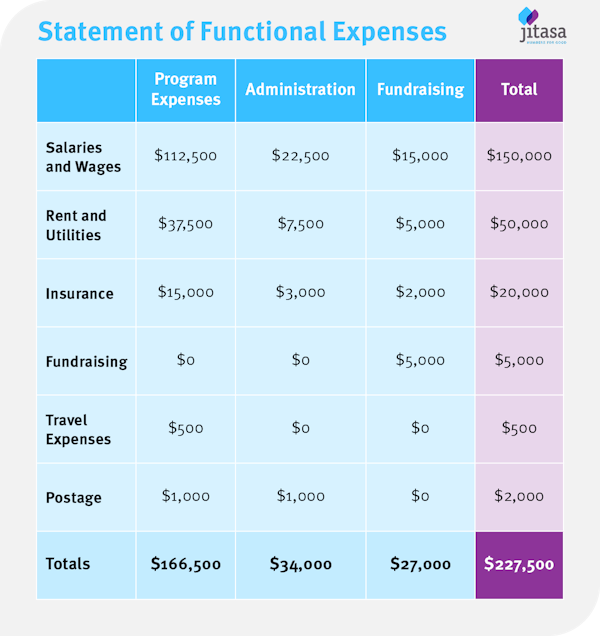

Keep in mind that some natural expenses might need to be divided across multiple functional expense categories, as they are in this example:

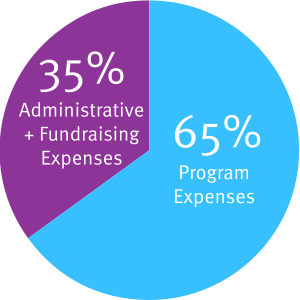

While the term “overhead expenses” doesn’t appear on this statement, it’s often referenced in the context of functional expenses because it refers to your nonprofit’s administrative and fundraising costs combined. You may have heard of the 65/35 rule, which states that nonprofits should put at least 65% of their funding toward program expenses and spend no more than 35% on overhead:

In reality, this breakdown will look different for every nonprofit. It’s best to treat this “rule” as a guideline—when reviewing your statement of functional expenses, look for areas where you could reduce overhead spending and put more funding toward your programs in the future.

In addition to providing detailed insights into your nonprofit’s spending over the past year, the main purpose of the statement of functional expenses is to help you file your organization’s annual tax return. Although you only need to provide a complete functional expense report if your nonprofit files the full Form 990, the other three variations (Form 990-N, Form 990-EZ, and Form 990-PF) ask some questions about the costs your nonprofit has incurred. Having a detailed report of your expenditures will make it easier to fill out these sections.

How to Create Financial Statements for Your Nonprofit

Because all of the information that goes into the four major nonprofit financial statements should already be stored in your accounting software, there are two main ways to compile these reports. First, you could have someone at your organization pull the data you need and format it using one of the many financial statement templates available online. However, this method takes a lot of time and effort, especially when it comes to ensuring the templates are structured in a way that aligns with your nonprofit’s financial situation.

The best way to create accurate, useful financial statements for your organization is to work with a nonprofit accountant. Since many nonprofits don’t have a full-time accountant on staff, consider outsourcing your accounting needs to a nonprofit-specific firm like Jitasa.

The experienced team at Jitasa has compiled, distributed, and analyzed financial statements for organizations of all sizes. Plus, Jitasa works exclusively with nonprofits, giving you access to the expertise necessary to correctly craft these reports and glean applicable insights from them.

Proper reporting is a key aspect of effective nonprofit financial management. Compiling the four major financial statements for your organization benefits your internal operations, external compliance, and overall level of accountability from year to year. As you begin creating your statement of activities, balance sheet, cash flow statement, and functional expense report, don't hesitate to reach out for expert assistance to ensure accuracy and help you apply the conclusions you draw to your organization's operations.

To learn more about how your financial statements fit into the larger picture of nonprofit accounting, check out these resources:

- Fund Accounting 101: The Basics and Best Practices. Explore the nonprofit-specific system of fund accounting that forms the backbone of the four financial statements.

- Establishing a Nonprofit Chart of Accounts [+ Template]. Discover the main resource for tracking the data that goes into your nonprofit’s reports: your chart of accounts.

- Working With a Nonprofit Accountant: What to Expect. Dive deeper into the various responsibilities of a nonprofit accountant and learn more about what it’s like to partner with one.

Work with the accounting experts at Jitasa to compile and analyze your nonprofit financial statements.

Request a Quote