Nonprofit Accounting: A Guide to Basics and Best Practices

Monday, June 5, 2023

When you first started working at your nonprofit, what entranced you? What was the driving force behind your starting work there? Chances are, it wasn’t tedious paperwork, challenging calculations, and compliance regulations. What likely drove you to join was (and continues to be), the nonprofit’s mission.

However, that paperwork, number crunching, and other tedious tasks come with the territory of running an effective nonprofit organization. One such activity that many nonprofit professionals don’t want to deal with is nonprofit accounting.

Luckily, here at Jitasa, we don’t think nonprofit accounting is tedious at all! We’ve loved helping over a thousand organizations organize and maintain their finances. Due to this love of the craft and experience in the field, we decided to put together this guide to help nonprofits like yours better understand their accounting needs.

But first thing’s first, let’s make sure we’re all on the same page about nonprofit accounting:

What is Nonprofit Accounting?

Nonprofit accounting is the unique process by which nonprofits plan, record, and report upon their finances. While for-profits primarily focus on earning a profit, nonprofits focus more on the accountability aspect of accounting. They follow a specific set of rules and procedures that help them stay accountable to their donors and contributors.

In the rest of this article, we’ll cover the basics and best practices that all nonprofit professionals should know about accounting. Understanding the basics will help you better manage and plan your programs in a way that brings the most value from your finances.

Jitasa’s nonprofit accounting experts can help your team get your finances in order.

Learn MoreBasics and Best Practices of Nonprofit Accounting:

- How Nonprofit Accounting is Different

- Nonprofit Accounting Statements and Reports

- Best Practices for Nonprofit Accounting

- To Hire or Outsource for Nonprofit Accounting

- Our Nonprofit Accounting Recommendations

Ready to learn more about your nonprofit’s finances? Let’s get started.

1. How Nonprofit Accounting is Different

As we mentioned before, nonprofit accounting focuses on the accountability aspect of finances. Your nonprofit’s donors have the right to set restrictions on the donations they contribute to your organization and grant funders want to make sure their funds are spent on the agreed-upon programs. These restrictions mean that you have to ensure their funds are spent in a way that the supporters approve of. That’s why nonprofits employ a type of accounting known as fund accounting.

Fund accounting enables nonprofits to allocate their money into different groups or “funds” in order to keep them organized and only spend funds on what they’re designated for.

Nonprofits will commonly separate their money into groups such as:

- Restricted funds. These are the funds that must be spent on certain projects and activities at your organization.

- Temporarily restricted funds. These funds should be spent on certain projects and activities at your nonprofit until a certain time period. After that time, they become unrestricted funds.

- Unrestricted funds. This is also known as your annual fund. It can be spent on whatever aspects of your organization require the greatest need.

Another aspect of nonprofit accounting that helps organizations stay accountable to their finances is the nondistribution constraint. This is a vital aspect of accounting that helps define nonprofits. Unlike for-profits, nonprofits are required not to distribute their net earnings to the leaders at the organization.

For example, if The Good Dog Animal Shelter found an extra $10,000 in their budget, they wouldn’t be able to distribute these funds to the executives and board members. That additional funding needs to be reinvested in the mission.

2. Nonprofit Accounting Statements and Reports

Nonprofit accounting isn’t a free-for-all. Nonprofit accounting professionals must adhere to specific guidelines when they create reports. The primary guidelines your organization should know about are the GAAP standards.

GAAP stands for Generally Accepted Accounting Principles. These are (as the name states) general principles accepted by accountants in all sectors. These guidelines are set by an organization called the Financial Accounting Standards Board (FASB).

In accordance with these standards, there are several types of documentation that your organization should be aware of. We’ll walk through the various types of documents that your finance department will likely be working with most frequently.

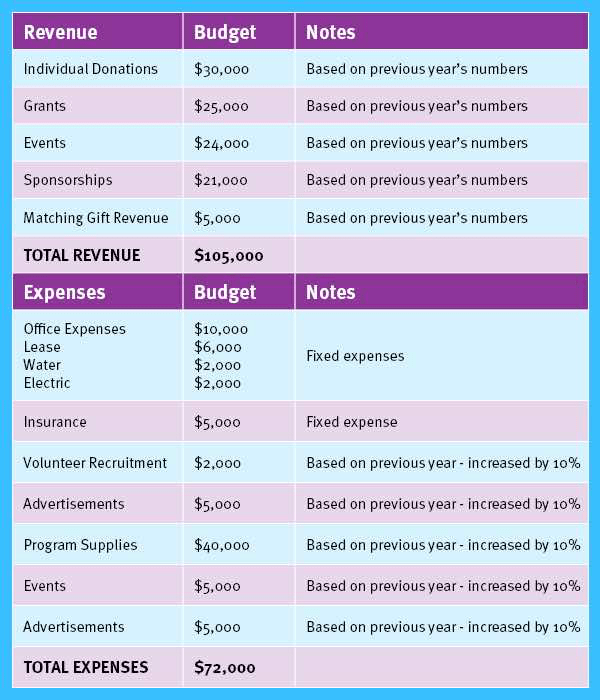

Nonprofit Budget

Your nonprofit’s budget is the document that individuals at your organization are more likely to be familiar with. This document is created by your leadership or finance team using information from your development team and historic spending habits from your organization.

Your nonprofit budget is the planning document used to predict expenses and allocate resources for your organization. It details both the costs that your organization will incur as well as the revenue you expect to receive over a set period of time, usually a year.

When you analyze each aspect of your budget, you’ll need to understand how they’re figured and calculated:

- Expected revenue. Your expected revenue can be calculated using historical figures and two different calculations: the cutoff method and the discount method.

- The cutoff method requires you to take each separate revenue stream and multiply it by the probability that you’ll receive the funding. For instance, if you have an 80% chance of receiving a certain grant, you’d multiply the grant funding by 0.8.

- Meanwhile, the discount method requires you to take the entire expected revenue, but factor it by the probability of receiving the revenue. For instance, if you expect to receive a total of $500,000 in revenue, but believe you have a 75% chance of achieving that revenue amount, you’d enter $375,000 in your budget.

- Expense budget. Your expense budget will divvy up the expenditures for your organization into different categories (and further if you so decide). These categories will include but are not limited to fundraising expenses, administrative expenses, and program expenses.

The finished budget will look something like the one below:

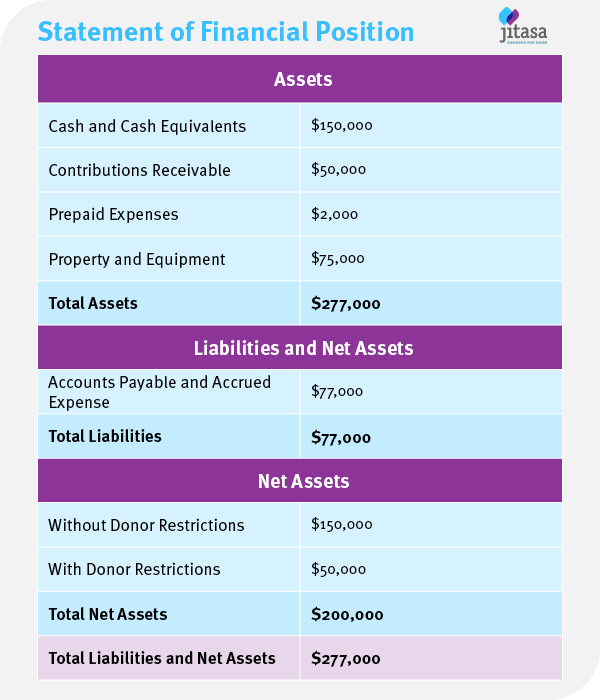

Statement of Financial Position

Your nonprofit’s balance sheet is also known as the statement of financial position. This is the document that most represents the financial health of your nonprofit.

This document is where you can find the lists of assets and liabilities for your nonprofit. When you boil it down, the statement of financial position in nonprofit accounting can be summarized by one simple equation:

Net Assets = Assets - Liabilities

By understanding how these variables work together, you’ll be able to better understand the general financial health of your organization using this valuable document. Positive net assets indicate healthier financials at your organization while negative net assets mean that you probably have some reprioritizing to do. We’ve created an example of what this report might look like for nonprofit organizations:

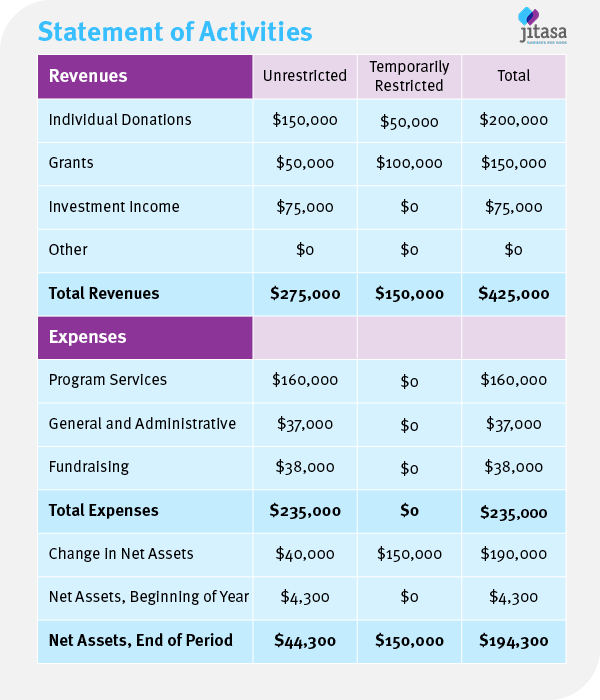

Statement of Activities

Your nonprofit’s statement of activities is also known as your income statement. This report shows the revenue and expenses over time at your organization. It’s used to categorize your different revenue sources and expenses. Plus, you can use this document to review your change in net assets from the beginning of the year to the end of the year.

For example, if you have $50,000 of restricted assets set aside for your scholarship program, then decide to provide a $5,000 scholarship, you’re not losing those funds. Rather, you’re using them for their intended purpose. This expenditure will be reflected on your statement of activities.

The example below provides an example of what a statement of activities could look like for your nonprofit:

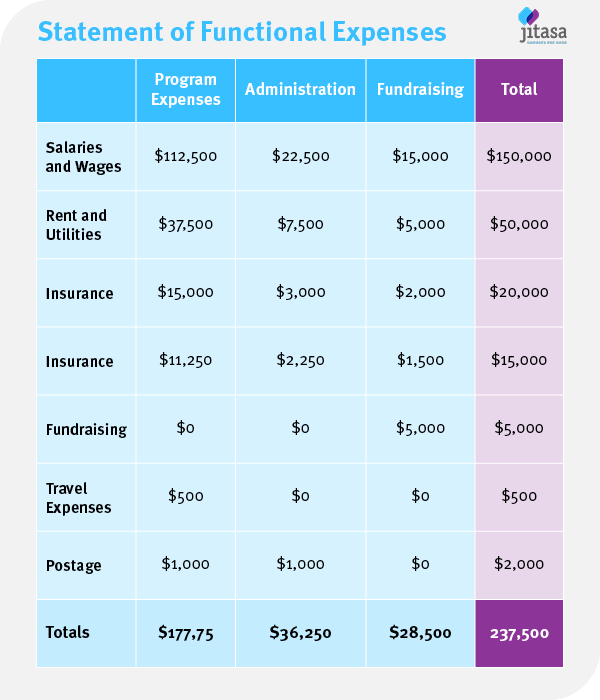

Statement of Functional Expense

Your nonprofit’s statement of functional expense breaks down your expenditures into various common categories, providing a “function” for each expense. This categorization will separate expenses into one of three operational functions: program expenses, administrative expenses, or fundraising activity expenses.

Providing detailed information on your statement of functional expenses also helps when it’s time to complete your annual Form 990 which requires expenses to be separated in a similar fashion.

Since 2017, you’re also required to disclose the “nature” of the activities your nonprofit lists on this report. For example, what percentage of your postage needs are for marketing materials and direct mail fundraising versus administrative duties like paying bills.

Here’s an example of what your statement of financial expenses might look similar to:

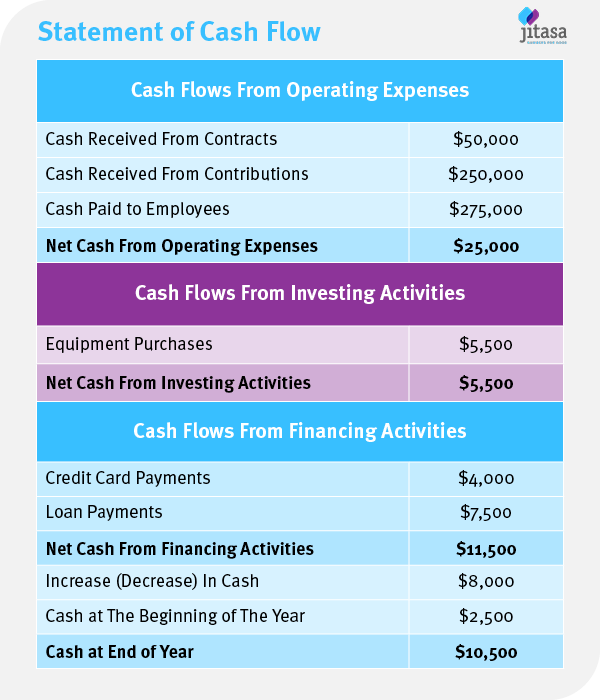

Statement of Cash Flow

Your nonprofit’s statement of cash flow shows how funding and cash moves in and out of the organization. It allows you to gauge how much is available to pay your expenses at any given time.

This nonprofit accounting statement breaks down the operating, financing, and investing activities to show how cash moves at the organization. You can easily see how your nonprofit uses the funding it receives from fundraising, grant seeking, and other revenue streams by analyzing this statement.

For an example of a statement of cash flow, check out the image below:

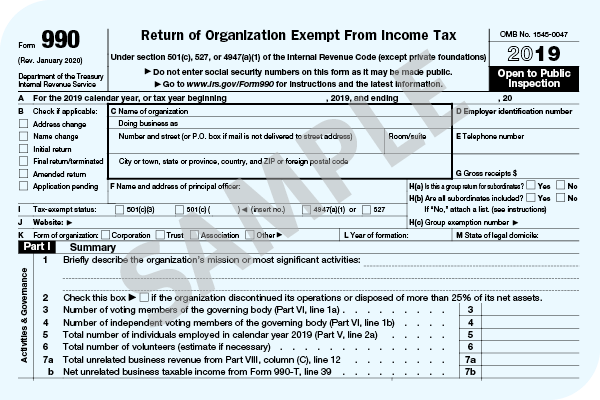

Form 990

Filing the annual Form 990 is a key aspect of nonprofit accounting, and one that can’t be overlooked. Form 990 is the annual tax form that tax-exempt (e.g. 501(c)3) organizations are required to file each year to remain compliant with the regulations and requirements set by the IRS.

In this document, you’ll record your nonprofit’s revenue and expenses from the year, to demonstrate how finances have been utilized. Essentially, the Form 990 is the IRS’s method of evaluation to make sure your nonprofit is financially honest and legitimate.

For a comprehensive overview of tax regulations for nonprofits, check out our comprehensive guide on Form 990 Filing. An example of this necessary nonprofit accounting document can be found below:

Nonprofit accounting may seem overwhelming at times. But, when you grasp how to read various accounting documents, it becomes much easier to understand how finances function and move at your organization.

However, nonprofit accounting isn’t just about pulling important information. You also need to understand how to use this information to implement best practices for effective accounting decisions.

The Beginner’s Guide to Nonprofit Accounting

This nonprofit accounting guide is great for anyone wanting to learn the foundation of nonprofit accounting.

Free Download3. Best Practices for Nonprofit Accounting

While your nonprofit bookkeeper records day-to-day financial information for your organization, your nonprofit accountant is responsible for reviewing bookkeeping entries, performing account and balance sheet reconciliations, preparing financial statements and reports, and reviewing the financials with you prior to closing the monthly period, so you can make the best financial decisions in managing your nonprofit.

In order to make the best financial decisions, nonprofit professionals should understand some accounting best practices. In this section, we’ll cover some best practices that nonprofit accountants can use to better handle their finances.

Don’t overthink overhead expenses.

Public viewpoints on overhead expenses hurt the nonprofit industry a great deal. Overhead includes those expenses that nonprofits use to cover administrative costs, market their mission for fundraising, and pay for other internal expenses that help the organization grow. Essentially, overhead expenses are those that nonprofits use to pay for anything that isn’t a program directly related to the organization’s mission.

Because nonprofits operate the same as a for-profit business, overhead is necessary for any nonprofit organization to function. For example, you have to pay people to run the nonprofit, dedicate an office space to get work done, and invest in a website to reach the public.

Some donors choose to judge nonprofits based solely on their overhead expenses. However, this narrative is changing in the sector as more people become aware that overhead is a necessary expense for growth. Encourage your donors to judge your organization based on your impact in the community rather than how much you spend on fundraising and administrative expenses.

While some nonprofits unfortunately are scams, the majority are trying to do real work to make a positive impact in the world. To qualify as a “nonprofit,” organizations must meet certain IRS requirements. If they fail to maintain a certain percentage of revenue spent on programs, they lose their nonprofit status, meaning that the majority of organizations are truly working to make a difference. If a donor has reservations about the nonprofit they’re donating to, they should speak with the organization directly about their financials. Encourage your supporters to come to you with any questions they may have!

Reference your budget frequently.

While your board members (who should be totally independently of your organization, meaning they, or their family members, should not be employed by the nonprofit) are involved in the annual budget approval process, this shouldn’t be the only time during the year that you take a deep dive into your budget.

You should check in with your budget monthly, comparing and evaluating your budgeted revenue and expenses against your actual revenue and expenses. This will ensure that your organization is staying on track to achieve your goals.

In addition, checking in on the budget one or more times each month will allow you to adapt to change. For instance, if programs or projects are discontinued, funding falls through, or your funding increases, you can address the issues and adapt your strategy right away. It’s important to review and adjust the spending budget for the remainder of the year to cut back expenses if necessary, or to further fund your mission if you receive unexpected funding.

Establish concrete internal controls.

Internal controls not only limit cases of fraud, but often aid in catching errors. Even if your nonprofit consists of only two employees, there should still be a “checks and balances” system in place. No matter how big or small nonprofits are, internal controls are essential for effective nonprofit accounting.

Small nonprofits especially struggle with implementing internal controls, but there are some specific guidelines you can follow such as:

- Share financial duties. For instance, if your bookkeeper records all incoming revenue for your organization, someone else should be the one to approve write-offs. This creates a system of checks and balances between roles at the organization.

- Instill security policies. Nonprofit cybersecurity can easily become a major risk to organizations, especially when you handle sensitive transactional information. Implement specific policies at your organization for the handling of this data.

- Take inventory of fixed assets. Some items are easily taken home from the office and forgotten about. Take regular inventory of the computers, cell phones, and other items that you allow your organization’s staff members to work with.

Internal controls don’t mean that you don’t trust your organization’s staff members. It really helps to catch any mistakes and prevent inadvertent wrongdoing.

Conduct regular audits.

Not only is a financial audit NOT a bad thing, it can actually be a very good thing. A nonprofit audit is meant to ensure the accuracy of the organization’s financials, as well as the financial health of the organization. In addition, when audit results are published for the public, the results aid in financial transparency with your current and future donors.

In addition, audits provide insight into the various opportunities that your organization has for financial stability and recording improvements. By addressing these opportunities for improvement now, you’ll help keep financial data secure and well-reported in the future.

Use specialized software.

Nonprofit accounting isn’t like all other accounting. Equipping yourself with the best software and people can make a world of difference for your organization. When you set up your software to record and safeguard your financial information, be sure you choose a solution that has specific configurations for nonprofit accounting, such as Quickbooks.

If you choose to outsource your accounting needs, be careful to choose experts or accounting firms that specialize in nonprofit bookkeeping and accounting, which can streamline your processes and make your life easier both now and in the future. The right nonprofit accounting experts ensure your knowledge of and compliance with nonprofit tax and accounting regulations is up to par, preventing costly mistakes from ever happening. Choose experts, and watch your nonprofit flourish.

4. To Hire or Outsource for Nonprofit Accounting

Does your nonprofit have a dedicated team member with both the skillset and capacity to handle your accounting needs? Many small to midsize organizations struggle to find someone to fill this role. Actually, 18% of nonprofits listed limited staff as their greatest challenge in 2019. This means that finding someone to take on these responsibilities (especially as you grow) can be immensely challenging.

Luckily, there are options that nonprofits can take into consideration when they’re looking for someone to fill the role of the nonprofit accounting professional. Consider the following:

- Roll the responsibilities up under an executive. Many brand-new organizations take this approach and simply allow their executive director to take on all financial responsibilities for the organization. However, the problem occurs when it’s time for the organization to grow. Not only will the accounting needs become more complex, but your executives will have other responsibilities and priorities on their minds.

- Hire a full-time accountant to join the team. Hiring a dedicated team member is definitely an option, and one that many large organizations have taken advantage of. However, for small nonprofits with limited resources, hiring additional staff members is an expense that needs to be carefully considered. Often, it’s not quite time to hire just yet.

- Outsource your accounting needs to an expert firm. The majority of nonprofits fall into the category of organizations who would benefit from outsourcing their accounting needs. These firms offer experts who have seen all sorts of nonprofit accounting needs and addressed them accordingly. Plus, they tend to be more affordable than hiring a new team member for your nonprofit accounting needs.

Our professional opinion is that the majority of nonprofits will benefit from outsourcing their bookkeeping and accounting needs, working directly with nonprofit accounting experts. It’s an affordable option that can provide access to deep nonprofit accounting experience and expertise.

If outsourcing your accounting needs sounds like a tempting option for your organization, be sure to look for a firm that works specifically with nonprofits. That way you can rest assured that they’ll be well-versed in fund accounting and able to answer nonprofit-specific questions.

5. Our Nonprofit Accounting Firm Recommendation

Jitasa’s accounting services are designed specifically for nonprofits. When you outsource your finances to us, you’ll have access to professionals who are not only experts in finance, but also understand the intricacies of the nonprofit world.

All Jitasa clients receive numerous benefits from our services, including:

- Access to experts. No matter what the situation is, our nonprofit accounting experts can, and want to help. Not only that, but it’s probably not the first time we’ve run into whatever issue you’re experiencing. Our experience in the field means that we have tried-and-true solutions to the common issues that nonprofits face.

- Enhanced internal controls. Your data security is our number one priority. We’ll work with you to establish policies that secure data at your organization. Plus, we have our own policies, procedures, and systems that are designed to keep your financial information safe.

- Access to Quickbooks. Fund accounting requires specific software to make sure everything is organized and easy to work with. That’s why we’ll get your nonprofit set up with Quickbooks Online’s fund accounting solution in order to store and report on all of your nonprofit accounting information.

As we said before, here at Jitasa, we love accounting! But we also love making a difference and driving good in the world. By working with nonprofit organizations, we get to do both. We’ll handle the finances so that you can focus on driving your mission and making an impact!

Nonprofit accounting is a unique field of finance. Understanding the key aspects of accounting will help your nonprofit better recognize the financial situation of your own organization.

If your accounting responsibilities still roll up under your executives, consider outsourcing your accounting to the experts at a firm. They’ll help make sure all best practices and internal controls are implemented, ensuring smarter finances.

If you’re looking for more information about nonprofit finances, we recommend diving deeper with the following resources:

- Working With a Nonprofit Accountant: What to Expect. Understanding how accounting works is only the first step to ensuring a positive relationship with your accountant. Learn more about what to expect with this comprehensive article.

- Bookkeeping and Accounting Services for Nonprofits. Learn more about what Jitasa can do for you when you choose to outsource your nonprofit accounting needs.

- Top 10+ Outsourced Nonprofit Accounting Firms. Check out these favorite nonprofit accounting providers to see which firm would be the best match for your nonprofit (and keep an eye out for Jitasa at #1!).

Nonprofit Accounting 101 Course

Take a deep dive into some of the basics of nonprofit accounting.

Free Course