In-Kind Donations: The Ultimate Guide + How to Get Started

Tuesday, January 23, 2024 by Jon Osterburg

Imagine you work for a nonprofit that provides relief for communities affected by natural disasters. Much of your fundraising work involves soliciting monetary donations from supporters that are then used to purchase bottled water, nonperishable food, batteries, and personal care items for your team to give to individuals in these impacted areas. Eventually, you start to wonder: What if we could get supporters to donate these items directly rather than going through the extra step of procurement that slows down our service delivery?

The answer is absolutely yes! In-kind donations, as these gifts are known, can be extremely useful in meeting the programming and fundraising needs of nonprofits of all sizes and in all verticals. In this guide, you’ll learn everything you need to know to start collecting in-kind donations, including:

- What are in-kind donations?

- Types of In-Kind Donations

- Benefits of In-Kind Donations

- In-Kind Donations And Gift Acceptance Policies

- Recording And Reporting In-Kind Donations

- How To Solicit In-Kind Donations

Let’s begin by making sure we’re all on the same page about what exactly these contributions entail.

Work with the nonprofit accountants at Jitasa to successfully navigate in-kind donations.

Request a QuoteWhat are in-kind donations?

In-kind donations include any and all non-monetary donations to nonprofits or causes. They refer to the transfer of any assets, usually goods or services, to your organization from an individual, company, or other nonprofit.

When your nonprofit receives monetary donations, you spend that funding on various organizational expenses. For example, you might set aside $5,000 to spend on website design and development in a given year. However, if a web developer gave your organization an in-kind donation of free design services, you’d be able to reallocate that $5,000 to a different area of your budget.

Explore the ins and outs of in-kind donations in our FREE course.

Learn MoreTypes of In-Kind Donations

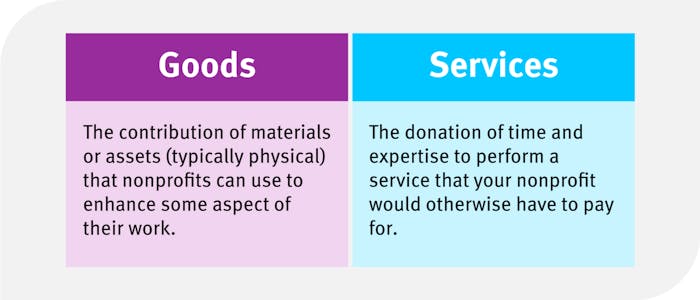

As mentioned previously, in-kind donations typically take one of two forms: goods or services. Let’s dive into each type in more detail.

Goods

An in-kind donation of goods refers to the contribution of materials or assets (typically physical) that nonprofits can use to enhance some aspect of their work. Some common examples include:

- Supplies to distribute to beneficiaries, like the disaster relief items discussed in the introduction.

- Items for organizations to keep and use when delivering services, such as used books for a library or sports equipment for a recreation center.

- Office equipment like computers and desks to assist with administrative needs.

- Materials for fundraisers such as auction prizes or tables and chairs for a gala.

Although they aren’t physical goods, contributions of stocks, real estate, and cryptocurrency are also considered in-kind donations because they involve the transfer of assets from an individual to your nonprofit.

Services

Rather than donating items, some individuals or organizations may choose to contribute their time and expertise to perform a service that your nonprofit would otherwise have to pay for. This can be especially useful when your organization is starting out and doesn’t have the financial bandwidth to outsource or hire specialized professionals yet, although larger nonprofits can also benefit from outside help. These in-kind donations could take the form of:

- Pro bono legal services from a licensed attorney.

- Bookkeeping and accounting services from a CPA.

- Web development or graphic design to help offset your marketing expenses.

- Free use of an event space to host a fundraiser, meeting, or conference.

In some cases, a donor might decide to accept the bill for a service on your organization’s behalf, which is also considered an in-kind donation.

Benefits of In-Kind Donations

In-kind donations can be incredibly important for furthering your nonprofit’s mission and for engaging your supporters. Some of the benefits for your organization include:

- Taking out the middleman. Rather than taking the extra effort to purchase items with your nonprofit’s financial resources, you receive exactly what you need up front.

- Creating a quicker approval and delivery process. With in-kind donations, you don’t have to wait for your organization’s leadership to sign off on your purchases or for goods to arrive if you order them online, allowing you to use the items right away.

- Allowing for more financial flexibility. You can use the funding you would have spent on the goods or services contributed in-kind for other needs at your organization.

In-kind donations also offer advantages for donors, including:

- An additional way to engage with your nonprofit. If donors aren’t able to give money, they can contribute their skills or the unopened and gently used items they already have on hand and still support your mission.

- A way to live more sustainably. By donating the possessions they don’t use rather than throwing them away, donors can have a more positive impact on the environment in addition to their communities.

- A more concrete understanding of their impact. It’s easier for donors to see the tangible effects that in-kind donations have on nonprofits—whether that’s books becoming more accessible to children or well-designed marketing materials that drive conversions—than it is with financial contributions.

While your nonprofit can benefit from any and all donations no matter the circumstances, in-kind donations are especially helpful during periods of economic turbulence, when donors are more strapped for cash and your nonprofit needs as much freedom as possible in allocating its funds.

In-Kind Donations and Gift Acceptance Policies

The greatest challenge most organizations face with in-kind donations is this: What happens when you receive a gift you can’t use?

Let’s say an animal shelter requests in-kind donations of various pet supplies, such as dog beds, kitty litter, and pet food, from its loyal supporter base. Gifts begin to flow in, and the shelter’s staff is excited about the improved level of care they’ll be able to provide for the animals they rescue.

Then, the shelter receives a big container of contributions from a donor whose cat recently passed away. The staff is just thinking that the rescue cats will love the gently used toys and brand-new packet of catnip in the container when they encounter the bag of kibble—which is open and half empty. Giving this food to the rescue cats is a health and safety hazard, but this donor obviously meant well. What should the staff do in this situation?

The answer is to reference their gift acceptance policy, one of the core financial management guidelines every nonprofit should implement. This policy outlines:

- The types of gifts (both monetary and in-kind) that your organization can and can’t accept.

- The circumstances under which you’ll accept each gift.

- The procedure for recording different types of gifts.

By showing the donor the official policy that states that all donated pet food needs to be unopened, the animal shelter in our example can politely decline the gift without coming off as ungrateful.

Additionally, if the shelter were to explain the policy in their supporter communications, they could encourage even more eligible in-kind contributions! Your gift acceptance policy not only tells supporters what not to give but also provides some direction as to what they can do to make the greatest difference for your mission.

Use our customizable template to create your nonprofit’s gift acceptance policy.

Download for FreeRecording and Reporting In-Kind Donations

Once your nonprofit starts bringing in useful in-kind donations, you’ll likely encounter two additional challenges: how to correctly track these contributions in your accounting system and how to report them for tax purposes. Fortunately, the experienced team of nonprofit accountants at Jitasa has you covered! We’ll walk through resolving each of these issues in the following sections.

Accounting for In-Kind Donations

Properly recording your organization’s in-kind contributions is necessary not only for tax reporting, but also to comply with certain states’ regulations and the Generally Accepted Accounting Principles (GAAP). Plus, if your nonprofit conducts an independent financial audit for any reason, your auditor will want to see a thorough record of all donations—monetary and in-kind.

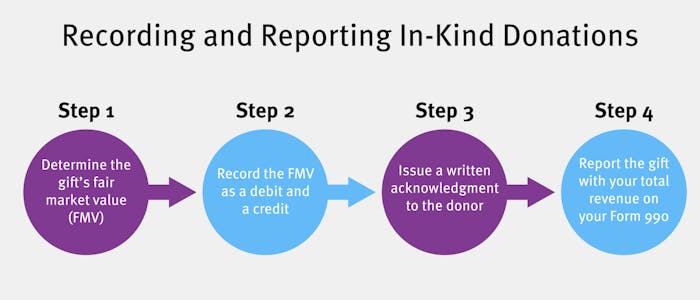

When you go to record an in-kind donation, the first thing you’ll need to do is figure out its fair market value (FMV). This is defined as the price you would pay for a good or service if you purchased it on the open market. There are a few ways to determine FMV depending on the item:

- Goods with straightforward values: Look at the price tag on the item or search for it online and check the prices (without discounts) on major retail sites. For example, if someone donates a brand-new iPad to your nonprofit, the list price for that model on Apple’s website is the FMV. Keep in mind that used goods may depreciate over time—ask your accountant for advice on specific items.

- One-of-a-kind goods: This most often applies to unique auction prizes like custom artwork or signed celebrity memorabilia. In these situations, first check with the item’s provider, but take their estimate with a grain of salt as many owners of unique goods tend to overvalue them. Then, see if you can find comparable items for sale on websites like eBay or Etsy and compare their prices to the provider’s estimate.

- Services: Depending on the donor’s fee structure, ask them how much they would usually charge to complete a project like the one they’re doing for your organization, or find out their hourly rate and track the number of hours they spend working for you.

From there, record your in-kind donations in a separate revenue account as designated in your organization’s chart of accounts. Since the amount of cash your nonprofit has on hand doesn’t change when you receive an in-kind donation, the gift’s net value should equal zero. Record its FMV as both a debit and a credit in your accounting system.

In-Kind Donations and Taxes

There are two aspects to consider when discussing in-kind gifts and taxes. On the donors’ side, the main concern is tax deductibility. On your nonprofit’s end, you have to know how to report these donations on your annual tax return.

Are in-kind donations tax deductible?

In most cases, in-kind donations are tax-deductible for donors. However, the IRS requires that your nonprofit provide written acknowledgments in order for your supporters to receive their deductions, which should include:

- Your nonprofit’s name and employer identification number (EIN)

- The date that you received the item or that the service was completed

- A description of the goods or services contributed

- A statement confirming that the supporter didn’t receive anything in exchange for their gift

Unlike the donation acknowledgment for a monetary contribution, your organization isn’t legally allowed to provide the value of the donation for the donor—it’s up to them to provide it. Additionally, remember that this acknowledgment is a form of donor recognition, so you should also take the opportunity to show your appreciation for their gift.

Do in-kind donations have to be reported on your nonprofit’s Form 990?

In short, yes. The full Form 990, Form 990-EZ, and Form 990-PF all require your nonprofit to report your total revenue for the year, including the credit values of in-kind donations.

The IRS typically requires additional paperwork for a few types of in-kind donations:

- Items worth more than $25,000

- Historical artifacts or artwork

- Vehicle donations worth $500 or more

If your organization receives any of these donations, double-check the regulations to ensure you file all of the forms you need to properly account for them. Additionally, make sure to follow all reporting requirements for the state in which your organization operates.

How to Solicit In-Kind Donations

Just like financial contributions, you can cultivate in-kind donations and tell supporters exactly what it is you need to further your mission. Consider asking for these gifts in the following ways:

- Create a dedicated page on your website. If you need recurring items at your organization, add a permanent page to your nonprofit’s website listing these items and providing drop-off instructions. This is most helpful for small-scale in-kind donations like the pet food or disaster relief supplies in our earlier examples.

- Write individual letters asking for the in-kind donations you need. For larger gifts like technology or expensive services, look through your donor database to see who might be interested in making these contributions. Then, write a tailored letter to that supporter just like you would for a significant monetary donation.

- Register for a wish list when starting new initiatives. If you’re launching a new program or project that requires specific items, create a registered wish list using a platform like Amazon. Share the wish list with your supporters so they can each pick out an item that resonates with them and aligns with their budget.

- Reach out to current and potential corporate sponsors. Especially if you’re looking for in-kind donations leading up to a fundraising event, your sponsors may be happy to contribute items in addition to or in lieu of financial support. For instance, a nearby beauty supply store could donate a gift basket of their products as an auction prize, or a grocery store could contribute snacks and water bottles for participants in your 5K race.

Dedicated donors—both individuals and businesses—want to help your nonprofit by giving you gifts that will be useful for you. Make it easy for them by telling them exactly what you need and how to contribute those things.

If you’re ready to start bringing in more in-kind donations, get your team together and brainstorm what types of gifts would be most helpful for your organization right now. Then, make sure they’re covered by your gift acceptance policy and start reaching out to your individual and corporate supporters. Once you begin to receive donated goods and services, partner with nonprofit accountants like the team at Jitasa to help you record and report them correctly.

For more information on in-kind donations as they relate to nonprofit finance, check out these resources:

- Nonprofit Budgeting: Understand the Basics [+ Template]. Learn how to create an effective budget for your organization while taking into account both monetary and in-kind gifts.

- Nonprofit Form 990 Filing: An Essential Tax Guide. Dive deeper into the reporting requirements (for in-kind donations and otherwise) on your organization’s annual tax return.

- Working With a Nonprofit Accountant: What to Expect. Discover what it’s like to partner with a nonprofit accountant to record donations, file tax forms, create reports, and more.