Nonprofit Statement of Cash Flows: Complete Guide + Example

Thursday, October 14, 2021

Around 3 in every 5 Americans don't know how much they spent last month. Personal financial management is a challenge for the majority of people. But your nonprofit should have better management strategies to track and understand its own finances.

Without effective financial management, nonprofits run the risk of misallocating their funds, potentially leading to poor program management, wasted resources, and non-compliance with funding guidelines. Good nonprofit accounting practices are therefore essential to managing a well-run nonprofit.

Your nonprofit leverages (or should leverage) a number of financial statements to maintain consistent visibility into the financial health of the organization and to make decisions that will help prevent misallocation. These statements are pulled from the chart of accounts, which maintains a running record of the various ledgers kept at your organization.

With accurate tracking of financial information, you can see how money is used at your organization over time. It can help you determine the amount of cash you have at any given point and help you make current and future financial decisions.

The financial statement that will help you understand the movement of cash at your nonprofit is the nonprofit statement of cash flows.

In this guide, we’ll walk through what the statement of cash flows looks like and the part it plays in the financial strategy for nonprofits like yours. Specifically, we’ll cover the following topics:

- Understanding the Nonprofit Statement of Cash Flows

- Importance of Nonprofit Cash Flow Statements

- Conclusions to Draw From a Nonprofit Statement of Cash Flows

- Example Cash Flow Statement for Nonprofit Organizations

Keep your financial documentation organized so that you can easily look back at your nonprofit statements of cash flows over time to draw long-term conclusions. You can leverage the example at the end of this article as a template on which to base your own cash flow statement.

Contact Jitasa to help create and analyze your statement of cash flows.

Contact JitasaUnderstanding the Nonprofit Statement of Cash Flows

A nonprofit statement of cash flows is a financial report that shows how cash moves in and out of an organization on a regular basis.

This report is pulled on a monthly basis and is typically composed of three primary sections. These sections include the cash flows from:

- Operating activities

- Investing activities

- Financing activities

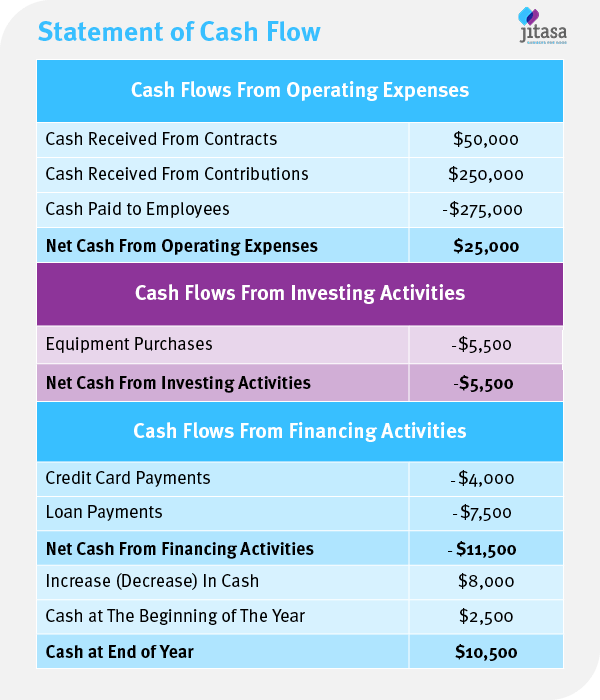

Each of these sections breaks down further to provide more insight into the specific activities that are bringing funds into the organization and how those funds are being spent. For instance, consider the following example of a nonprofit cash flows statement from a single month:

Consider the section titled “Cash Flows From Operating Expenses.” In this example, you can see that the cash received from contracts and contributions add up to $300,000. However, the cash paid out to employees is $275,000, meaning that money is cash flowing out of the organization. In total, the net cash from operating activities is therefore $25,000.

When you analyze your nonprofit’s statement of cash flows, you not only know how much money is flowing into your nonprofit, but (unlike the majority of Americans) you also know exactly how much cash is spent in any given month. If you gain $10,000 in grant funding, but spend $12,000 on programming, you’ll end up in the red and slowly deplete your reservoir of resources over time. This means you’ll need to make some adjustments.

Nonprofit cash flow statements can be recorded using one of two different methods: direct or indirect. Make the decision of which one your organization will use prior to pulling this report so you can be sure it’s accurate and consistent from month to month.

Direct vs. Indirect Cash Flow

The direct method of cash flow calculates your statement of cash flows based on the cash transactions made by your organization. Here are some factors to keep in mind about the direct cash flow method:

- It tends to be more time consuming to compile the statement of cash flows

- Reconciliation must be done to separate the cash flows

- Depreciation is ignored using the direct method

- This method tends to be more accurate than the indirect method

Very few organizations choose to leverage the direct method of cash flows. Instead, most choose to use the indirect method. The indirect method of cash flows uses net income as the basis, then calculates the net adjustments for assets and liabilities to create the statement of cash flows. Here are some factors to consider about this method:

- It’s a faster way to compile your statement of cash flows

- Net income is already transformed into cash flow

- Depreciation is taken into account with the indirect method

- Adjustments are made, so this method cannot be considered completely accurate

After analyzing a statement of cash flows, your nonprofit team should have a good idea of the liquidity of your nonprofit and how much funding you have on hand at any time.

Importance of Nonprofit Cash Flow Statements

Have you ever overdrafted from your bank account because you didn’t realize how much you had already spent? Or perhaps had a credit card declined when you reached the limit earlier than anticipated? These things happen when individuals don’t understand how much money is flowing in and out of their various accounts. The statement of cash flows can prevent this for your nonprofit.

Essentially, your nonprofit statement of cash flows provides a close-up analysis of your organization’s spending and fundraising habits. There are several reasons why it’s so important to keep track of your cash flows:

- Over time, cash flow statements provide insight into spending and fundraising habits of your nonprofit.

- Understanding the habits and general flow of cash over time helps organizations create more accurate budgets.

- You can uncover potential risks and opportunities regarding your nonprofit’s financial situation from your statement of cash flows.

Recording accurate information is the first step to ensuring this important statement is as helpful as possible for your organization. The second step is to ensure you’re drawing the correct conclusions from the document, which we’ll cover in more detail in the next section.

Conclusions to Draw From a Nonprofit Statement of Cash Flows

Once you have a completed statement of cash flows for your nonprofit, it’s time to analyze it and draw conclusions that your organization can leverage for better financial management in the future.

We recommend discussing the takeaways from your nonprofit statement of cash flows with a professional nonprofit accountant.

Accountants have the expertise and experience to not only identify the important aspects of your statement of cash flows, but also to draw the necessary conclusions and make recommendations based on the information it provides.

Two of the metrics that your nonprofit accountant might highlight within your statement of cash flow include:

- Free cash flow. Your nonprofit’s free cash flow describes the amount of liquidity your organization has to fund growth strategies. Essentially, this metric describes how much financial flexibility your nonprofit has.

- Cash flow to debt. If your nonprofit carries debt, your cash flows statement can show how much cash your organization has on hand to service debt issues.

You can also make predictions about the future cash flow of your organization based on the nonprofit statement of cash flows. For instance, you can:

- Use the expenditures shown in your cash flow statement to better understand and budget for expenses throughout the year. Understanding how money moves out and comes in on a monthly basis allows you to account for the variability of fundraising and expenses throughout a given year.

- Use the investments to predict your future cash flow related to investing activities. If you hold investments, you can better predict future dividend payments and account for that in future budgets.

The statement of cash flows is often confused with the nonprofit statement of activities (the equivalent of the for-profit income statement). While your statement of activities measures the value of your revenue against your organization’s expenses, your statement of cash flow is intended to show how cash moves in and out of your organization.

The Beginner’s Guide to Nonprofit Accounting

This nonprofit accounting guide is great for anyone wanting to learn the foundation of nonprofit accounting.

Free DownloadExample Cash Flow Statement for Nonprofit Organizations

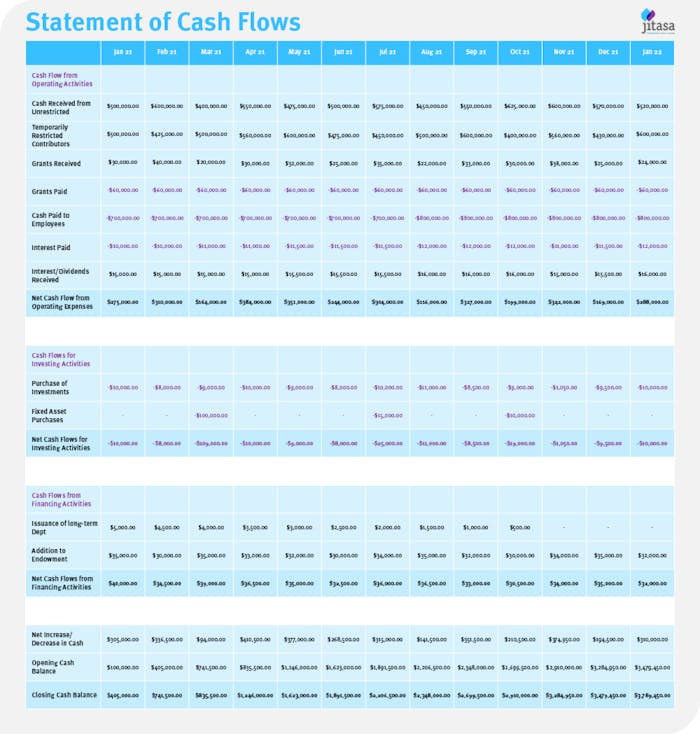

You can either analyze your nonprofit’s cash flow statement by individual months or by viewing various cash flow statements over time. Generally, for the second option, you’ll view the last 13 months of cash flow statements to be able to view trends in cash flow over time.

Below, we’ve included an example that your organization can use to see what this report will look like over time. If you isolate a single column, that’s the example of the statement of cash flow for a single month.

While you can pull this report together on your own, we highly recommend reaching out to a professional instead. A trained accountant can help your team pull an accurate report, interpret the information included, and draw conclusions for next actions to take.

How Jitasa Can Help

If you’re looking for help with your nonprofit statement of cash flows, we recommend reaching out to Jitasa accountants. Our trained accounting professionals will not only help your organization compile an accurate report, but we’ll also help you interpret the findings from it.

Reach out to get in touch with a member of the Jitasa Strategic Advisory Team (J-SAT). Each member has at least five years of experience as a CFO and over ten years of experience as a leader in nonprofit finance.

These experienced members will help your team leverage technology to pull your nonprofit cash flows statement and forecast for future statements. Then, our team will analyze this document as well as other resources to identify potential risks, opportunities, and scenarios that could occur. From there, we’ll provide recommendations regarding how to maintain healthy financial management practices at your organization.

If you’re interested in learning more about nonprofit accounting, statements, and Jitasa’s services, check out the following resources:

- Jitasa’s Advisory Services (J-SAT Team). Learn more about the advisory services offered by Jitasa’s team of CFOs and nonprofit finance professionals.

- Nonprofit Budgeting: Understand the Basics + Template. You can use your nonprofit statement of cash flows for better budgeting. Learn more about nonprofit budgeting with this guide.

- Working with a Nonprofit Accountant: What to Expect. See what it’s like to work with an accountant to help manage your organization’s finances.

Looking for help creating and interpreting your nonprofit statement of cash flows?

Contact Jitasa's J-SAT team today!

Learn more