GivingTuesday Best Practices to Align Fundraising & Finances

Thursday, October 16, 2025 by Delanie Miller

GivingTuesday is a peak fundraising day for charitable organizations around the world. As a nonprofit professional, you’ve likely worked on campaigns for this global giving day. If so, you know that a successful GivingTuesday depends on a solid strategy beforehand and careful analysis afterward—not only when it comes to fundraising and donor engagement, but also for managing your finances effectively before, during, and after the campaign.

In this guide, you’ll learn all you need to know about making the most of GivingTuesday for your nonprofit, including:

- GivingTuesday FAQ

- GivingTuesday Best Practices: Before Your Campaign

- GivingTuesday Best Practices: During Your Campaign

- GivingTuesday Best Practices: After Your Campaign

GivingTuesday is just one of many activities at your nonprofit where fundraising and financial management efforts need to align for maximum results, but it’s a great place to start because of how important this day is for nonprofits. Let’s get started!

Partner with the experts at Jitasa to develop a financially sound GivingTuesday strategy.

Request a QuoteGivingTuesday: Frequently Asked Questions

Before we dive into actionable strategies for GivingTuesday, let’s learn a bit more about the origins of this celebration of generosity.

What is GivingTuesday?

GivingTuesday is a global generosity movement in which hundreds of millions of people contribute time, money, and other resources to organizations and causes that matter to them. While some people start their own community movements on this day, many individuals and businesses prefer to support established nonprofits that run special campaigns for it.

Since its creation in 2012, GivingTuesday has been celebrated on the Tuesday after the Thanksgiving holiday in the United States, so it either happens during the last week of November or the first week of December. This makes it a great way to kick off your organization’s critical year-end giving season!

Why is GivingTuesday important for nonprofits?

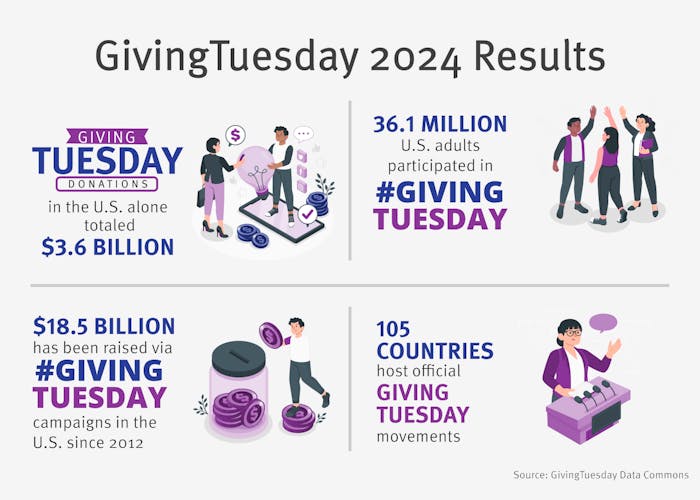

If your nonprofit hasn’t previously launched a GivingTuesday campaign, the data speaks for itself on why now is the perfect time to start! Check out these statistics from GivingTuesday 2024 (the most recent results available at the time of this article’s publication):

- GivingTuesday donations in the U.S. alone totaled $3.6 billion (a 16% increase over 2023).

- 36.1 million U.S. adults participated in GivingTuesday in some way (donating, volunteering, spreading awareness of causes, etc.).

- GivingTuesday fundraising efforts in the U.S. have generated a total of $18.5 billion since 2012.

- 105 countries host official GivingTuesday movements.

Plus, since GivingTuesday kicks off the year-end fundraising season, it’s worth noting that approximately 30% of annual nonprofit giving occurs in December. A good GivingTuesday performance can set you up for a strong year-end campaign as well!

What resources are available to help my nonprofit plan for GivingTuesday?

Your organization has a lot of tools at its disposal to streamline the planning process and help you achieve your GivingTuesday goals! A few of these include:

- Official GivingTuesday resources: The GivingTuesday team has written various articles about how to run a successful campaign and provides downloadable graphics you can use in your promotional materials.

- Third-party educational content: Many organizations that serve nonprofits and philanthropy professionals have also published blog posts and downloadable resources that you may find useful to guide your process.

- Fundraising software: GivingTuesday has several official nonprofit software partners. Even if the platforms your organization uses aren’t on that list, a solid tech stack will make your fundraising much more efficient.

- External professionals: Depending on your nonprofit’s needs, you might partner with fundraising consultants, freelance designers, or outsourced financial management firms (like Jitasa!) to provide expert advice and additional hands for your campaign.

Arguably the most important resource you have available to you, though, is your team! GivingTuesday is an all-hands-on-deck effort, so everyone needs to be on the same page about your objectives and their responsibilities from start to finish.

Use our comprehensive checklist to stay on track with GivingTuesday preparation.

Download for FreeGivingTuesday Best Practices: Before Your Campaign

Now that you understand the importance and impact of GivingTuesday, it’s time to dive into how exactly you should go about launching your nonprofit’s campaign. The planning process will likely be the most involved aspect of GivingTuesday, so let’s start there.

Keep in Mind: The earlier you can start planning for GivingTuesday, the better! Many organizations begin preparing in September, but some start as early as June or July. The best timeline for your nonprofit will depend on staff bandwidth and past experience with GivingTuesday campaigns—the more you participate, the easier it gets!

Set Clear Goals

Every successful fundraiser (and financial plan, for that matter) starts with clear objectives. Your GivingTuesday goals might center around:

- Raising a certain amount of money

- Spreading awareness about your mission

- Attracting new supporters to your organization

- Retaining existing donors year-over-year

Once you generally know what you want to accomplish, make your goals more practical using the SMART method, meaning that they’re:

- Specific

- Measurable

- Attainable

- Relevant

- Time-bound

For example, you might set a goal to “raise $20,000 to support our ongoing community programs by the end of the day on GivingTuesday.” This goal is specific about what you want to accomplish, includes a metric and a deadline, and is relevant to your organization’s work.

To determine if your goal is attainable, review data from your previous GivingTuesday campaigns and assess your nonprofit’s current performance and capacity. If your nonprofit raised $18,000 last GivingTuesday and is generally in a better position this year, a $20,000 fundraising goal will push your team but likely won’t be out of reach.

After setting your goals, determine the specific strategies you’ll use to achieve them. For example, you might break your revenue goal down based on how much you plan to raise from different funding sources (more on this later!). Then, make sure your ideas align with your organization’s operating budget so you can stay on track financially throughout the campaign, and create a separate budget just for GivingTuesday if it’s helpful to you.

Develop a Marketing Plan

Among your nonprofit’s fundraising campaigns, GivingTuesday promotion is especially important because thousands of organizations fundraise on the same day. This means your nonprofit needs to stand out from the crowd to convince donors to support you over their other possible options.

As you create your GivingTuesday marketing plan, make sure to:

- Incorporate multiple marketing methods. The more channels you use, the more touchpoints you’ll create for supporters to hear about and contribute to your campaign. While you’ll likely prioritize digital marketing channels like website content, email, text messaging, online ads, and social media, print communications such as flyers and direct mail are still helpful for reaching certain audiences and supplementing online materials.

- Segment your supporters. Consider which supporter groups are most likely to prefer each communication channel, and tailor your messaging to that audience so that it resonates with them. For example, you might target direct mail appeals at older, wealthy donors, social media posts at younger volunteers, and digital ads at individuals interacting with your nonprofit for the first time.

- Consistently brand your communications. Include your nonprofit’s logo, colors, and fonts in all of your marketing materials to instill trust in your audience and make your promotions look more professional. Additionally, using the GivingTuesday heart logo and #GivingTuesday in your content will tie the campaign together and increase its visibility.

Marketing is one of the biggest upfront expenses for any fundraising campaign, so you’ll need to balance creating lots of high-quality content with your budget. Fortunately, there are plenty of free marketing tools you can use to reduce your spending, and your nonprofit’s corporate partners may also be willing to go in on co-marketing opportunities for GivingTuesday to help you save money.

Invest in the Right Software

Along with marketing, software may be another upfront investment for your GivingTuesday campaign, depending on how your organization’s existing tech stack looks. Make sure you have the following solutions in your toolkit early on:

- A robust constituent relationship management (CRM) system to track supporters’ donations, volunteer hours, event attendance, responses to marketing materials, and other participation in your campaign.

- An online form builder so you can create and share mobile-optimized digital registration forms and a GivingTuesday-specific donation page.

- A payment processor that accepts various payment methods—credit cards, ACH bank transfers, and mobile payments—while keeping donors’ information secure.

- Tools to manage various campaign elements, such as peer-to-peer fundraising solutions, crowdfunding platforms, corporate giving databases, or mobile bidding software for auctions.

- Accounting software to record and categorize all of the funding you bring in on GivingTuesday.

To that last point, if your nonprofit wants to upgrade its accounting tools before GivingTuesday, reaching out to an accountant is your best bet. If you partner with Jitasa, we’ll help you choose the right system and subscription plan for your organization’s needs. We’ll also configure it for nonprofit use, since the best accounting solutions on the market—QuickBooks Online, Sage Intacct, and Intuit Enterprise Suite—are designed for businesses and will need extra customization to work for your organization.

GivingTuesday Best Practices: During Your Campaign

The number one best practice for your GivingTuesday campaign itself is to diversify your revenue streams. By generating revenue in multiple ways, you’ll be more likely to reach your goals because you’ll engage more supporters with different giving preferences and have a stronger safety net in case one source falls short of expectations.

To help with your budgeting and recordkeeping, we’ve organized our favorite ways to bring in funds on GivingTuesday according to the five major categories of nonprofit revenue. Let’s look at each one in more detail.

Keep in Mind: Many nonprofit supporters also like to give back in non-monetary ways on GivingTuesday, so make sure to offer some volunteer opportunities and encourage supporters to spread awareness about your cause in addition to donating.

Individual Donations

As is probably the case year-round, individual donations will almost definitely make up the majority of your GivingTuesday revenue. Some ways you can collect individual donations during this particular campaign include:

- Launching crowdfunding campaigns to raise money for specific organizational needs.

- Creating a special text-to-give keyword to encourage mobile donations.

- Mailing fundraising letters to previous donors, ensuring they’ll arrive at least a week in advance so supporters can contribute online or postmark their gifts by GivingTuesday.

- Running a peer-to-peer fundraiser so loyal supporters can collect contributions from their family and friends on your behalf.

- Hosting an event like a gala, auction, walkathon, or benefit concert (your choice will depend on your available budget and target audience).

- Holding an in-kind donation drive to gather supplies for your nonprofit or its beneficiaries going into the new year.

Some of these fundraising methods have unique accounting considerations attached to them. For example, records of in-kind donations should show a net zero gain in cash, and you’ll need to split event revenue based on whether donors received something in return for their contribution (like admission to the event or an auction item) or not. Ask your accountant if you have any questions, and ensure you’re ready to properly record all types of individual donations before GivingTuesday.

Corporate Philanthropy

Many businesses of all sizes are just as eager to participate in GivingTuesday as individuals because they get to give back to their communities while boosting their reputations as socially responsible companies. Consider adding these corporate philanthropy revenue opportunities to your strategy:

- Matching gifts—some companies may offer special match rates for GivingTuesday (for example, they might match employees’ donations at a 2:1 ratio when they usually match 1:1), so ask around and encourage all eligible donors to submit match requests.

- Volunteer grants, which turn your campaign volunteers’ time into money.

- Sponsorships, where a business contributes money, goods like auction items, or services like catering to offset your campaign’s upfront costs.

- Internal employee giving campaigns—both financial and in-kind—that benefit your nonprofit.

Especially for sponsorships and internal fundraisers, work out the terms of your partnership with each company in advance so you know how you’ll both benefit from working together. For example, a business may get a mention on social media and in your event program in exchange for donating an auction prize. Noting this reciprocation is also important for accounting because, like with event revenue, you’ll need to record transactions where corporate supporters directly received something in return separately from ones where they didn’t.

Earned Income

A straightforward way to generate earned income on GivingTuesday is to design and sell branded merchandise. Include the official GivingTuesday logo alongside your nonprofit’s on these products, and release them in advance so supporters can spread the word about your campaign as they wear or use their new clothing, drinkware, and other items in public.

If your nonprofit charges fees for services, you could offer a GivingTuesday special on those services to encourage more supporters to use them and secure earned income that way. For instance, an animal shelter could reduce adoption fees to help send more pets to their forever homes. Or, the organization could host a one-day clinic where pet owners can bring their dogs and cats for vaccines, microchipping, and basic grooming services like nail trims.

Investments

Since investments generally focus on long-term revenue generation, they likely won’t be a priority for GivingTuesday fundraising. However, you might use GivingTuesday as a reminder to check on your investments before the end of the year. You could also consider setting aside some of the revenue you bring in from other sources to invest for the future.

Grants

Most government and foundation grants also take a long time to secure and spend, so they won’t be a major part of your GivingTuesday fundraising strategy either. There are two unique types of grants you can leverage for this campaign, though:

- Challenge grants: These donations are contingent upon your organization reaching a specific fundraising target. For example, a challenge grant donor might pledge to donate $2,000 after your nonprofit raises $4,000 in individual online donations on GivingTuesday or match your crowdfunding campaign total once it reaches its goal. Challenge grants often come from foundations, businesses, or individual major donors.

- Marketing grants: Applying for these grants before GivingTuesday can help you offset some upfront marketing expenses. For example, the Google Ad Grant gives eligible nonprofits $10,000 per month in search advertising credits, which you can use to drive more traffic to your website before and on GivingTuesday.

Additionally, because most traditional grants are restricted to certain projects and programs, remember not to use that funding for any upfront GivingTuesday costs. Instead, start by covering as much as you can with corporate sponsorships and marketing grants since those are campaign-specific, then use unrestricted funding to pay for the rest.

GivingTuesday Best Practices: After Your Campaign

When GivingTuesday ends, your work won’t quite be finished. You’ll still have several internal and external follow-up tasks to take care of, all of which use your campaign data in different ways.

Keep in Mind: Ensure you have systems in place to collect data on your GivingTuesday campaign before you launch it. Integrate your CRM with your fundraising and accounting tools to allow information to transfer automatically between platforms, saving your team time and reducing the risk of errors that often come with manual entry.

Evaluate Your Fundraising Success

After your campaign, review your collected data and compare your results with the goals you set at the beginning of the planning process. Determine whether you met, exceeded, or fell short of your objectives, and try to identify why you got those results.

These insights will inform several internal functions at your organization, particularly planning future GivingTuesdays. By understanding how you did in the past, you can set more realistic goals and push your team to fundraise more efficiently and effectively over time. Additionally, when you’re finalizing your budget, you’ll have a better idea of the actual revenue numbers you’ll have to work with going into the new year.

Demonstrate Your Campaign’s Impact

Your GivingTuesday data also has important external functions, one of which is to ensure supporters know that they played an integral role in your campaign’s success. Share information on participation rates, fundraising totals, and plans for the money you raised in your nonprofit’s:

- Thank-you notes. While including campaign-wide data in all of your notes is helpful, you should also tailor these messages to each supporter’s unique involvement in your GivingTuesday campaign. For instance, auction participants will probably want to know about that event’s fundraising and attendance totals.

- Annual report. In the financial section of your report, highlight how much of your revenue came from GivingTuesday using charts and graphs. You might also include pictures showcasing your community’s collective efforts and testimonials from staff members or volunteers about how the campaign made a difference for your mission.

- Marketing materials for upcoming GivingTuesdays. If you share how much you’ve raised during this campaign in the past, supporters will be more motivated to help you exceed those numbers in the future.

Highlighting the impact of key fundraising efforts like GivingTuesday proves your organization's credibility by demonstrating effective campaign management and mission-aligned use of contributions. This builds supporters’ confidence and encourages them to stay involved with your nonprofit long-term.

Report GivingTuesday-Related Finances

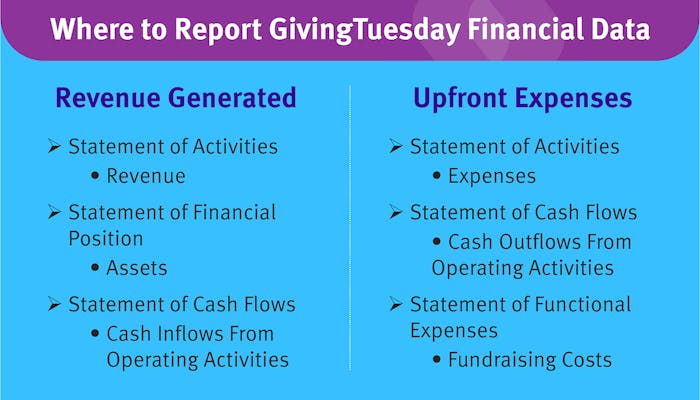

Supporters aren’t the only external audience who want to see your nonprofit’s GivingTuesday data. You also need to report the financial information you collect to comply with legal requirements for exempt organizations and cross-industry accounting standards like the Generally Accepted Accounting Principles (GAAP). In particular, you need to include GivingTuesday information—both revenue generated and upfront expenses—in your annual financial statements.

Record the funds you raise on GivingTuesday under:

- Revenue on your statement of activities.

- Assets on your statement of financial position.

- Cash inflows from operating activities on your statement of cash flows.

Record your campaign’s upfront expenses under:

- Expenses on your statement of activities.

- Cash outflows from operating activities on your statement of cash flows.

- Fundraising costs on your statement of functional expenses.

Each of these statements summarizes your nonprofit’s financial data in a different way to help you analyze and apply it. Consider attaching them as appendices to your annual report in case some readers want to dig deeper into your financial activities.

Your financial statements will also play an essential role in your next independent audit and help you file your organization’s annual tax return. If you have any questions, consult a nonprofit accountant.

An effective GivingTuesday campaign requires managing many moving parts—fundraising, supporter engagement, and financial considerations. Use the tips above to get started, and don’t hesitate to reach out to external professionals (like Jitasa for any financial needs!) to answer any questions or help you in any way you need to make your efforts successful.

For more information on nonprofit financial management, check out these resources:

- Nonprofit Revenue Recognition: What It Is & Why It Matters. Explore the unique factors that impact how your organization recognizes different aspects of its GivingTuesday revenue in its accounting system.

- Nonprofit Financial Statements: 4 Essential Reports to Know. Dive deeper into the primary reports your nonprofit will use to share its GivingTuesday financial information for compliance and transparency purposes.

- Nonprofit Bookkeeper vs. Accountant: What’s the Difference? Learn what distinguishes these two important financial roles and how both professionals can help you navigate the monetary side of GivingTuesday.

Simplify every aspect of GivingTuesday finances, from planning to reporting, by working with Jitasa.

Request a QuoteWhile your team focuses on inspiring donors for GivingTuesday, let our nonprofit experts ensure the financial side of your campaign runs flawlessly.