What Is Fund Accounting? A Guide to Basics & Best Practices

Tuesday, April 15, 2025

Nonprofit accounting is a unique beast. Rather than tracking their finances to try to turn a profit like businesses do, organizations like yours focus on the accountability side of accounting. Using a fund accounting system allows your nonprofit to do just that in its financial management.

In this guide, you’ll learn all you need to know about getting started with fund accounting, including:

- What is Fund Accounting?

- Fund Accounting vs. Traditional Accounting

- Benefits of Fund Accounting

- Types of Funds in Fund Accounting

- Fund Accounting Applications

Before we dive into the nuts and bolts, let’s make sure we’re on the same page about what exactly fund accounting is.

Work with Jitasa’s expert accountants to set up your nonprofit’s fund accounting system.

Request a QuoteWhat is Fund Accounting?

Fund accounting is a method of financial management that tracks the amount of money allocated to various operations at a tax-exempt organization. This system is designed to ensure your nonprofit uses funds productively and respects stakeholders’ wishes regarding their gifts.

Organizations that use fund accounting include:

- Traditional 501(c)(3) nonprofits

- Public, private, and family foundations

- Professional associations

- Healthcare organizations

- K-12 schools

- Colleges and universities

- Churches and other faith-based organizations

- Government agencies

Generally speaking, none of these organizations focus on earning a profit, and they’re all exempt from federal income tax. But to maintain that status, they have to reinvest all of their funding into their missions, and fund accounting helps them accomplish that goal.

Dive deeper into fund accounting with our FREE online course!

Sign Up TodayFund Accounting vs. Traditional Accounting

To help you understand just how different fund accounting is from traditional accounting, let’s dive deeper into these systems’ similarities and differences:

- Fund accounting, as we’ve established, is used by nonprofits and prioritizes accountability in financial management. In most cases, fund accounting systems deal with a wide range of funding sources, since your organization likely brings in funding through some combination of individual donations, corporate philanthropy, earned income, investments, and grants. Among these revenue streams, fund accounting differentiates restricted and unrestricted funds (more on these later!)

- Traditional accounting is business-focused and aims to help organizations maximize the profits they pay out to shareholders and investors. It typically deals with fewer revenue sources, since most businesses make most of their money through earned income from selling products and services (and the rest through investing). With this setup, there is no need to manage funding restrictions.

These differences greatly affect accountants’ on-the-job experience and training, which is why your organization should hire a team member or firm that specializes in nonprofit accounting and will understand your system of managing funds more deeply (like Jitasa!).

Benefits of Fund Accounting

In addition to the most notable benefit of a greater focus on accountability, your nonprofit can experience the following advantages by leveraging fund accounting:

- Ensuring compliance with nonprofit reporting requirements, particularly IRS Form 990 filing, which is critical for your organization to maintain its 501(c)(3) status.

- Allocating resources effectively by helping you know how much funding is already designated for certain initiatives so you can make up the difference and still have enough for other projects, programs, and overhead costs.

- Honoring promises to stakeholders, which improves your nonprofit’s reputation as an organization that respects its supporters and uses its funding wisely.

These benefits are only possible, however, if your nonprofit is transparent about its accounting activities. Keep your community updated on your financial activities and practices, and make reports publicly available (for example, post recent Form 990s on your website for easy access) so interested supporters can learn more about how you manage funds.

Types of Funds in Fund Accounting

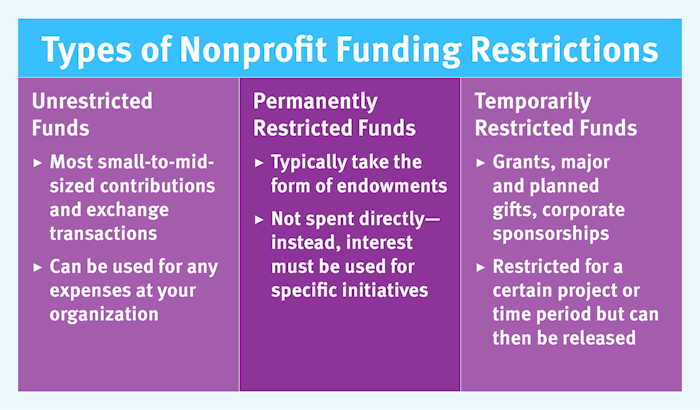

The “funds” in fund accounting fall into three categories that your nonprofit needs to record, allocate, and report on separately. These groups are based on whether the contributing individual or organization has designated their gift for a specific purpose or made a general donation. Let’s dive deeper into each category.

Unrestricted Funds

Unrestricted funding is just what it sounds like—revenue that your nonprofit can put toward any area of its budget. This includes:

- Administrative costs, which make up one part of your organization’s overhead and include many essential expenses that keep your nonprofit running day-to-day, such as staff compensation, utility bills, insurance, and office equipment purchases.

- Fundraising costs, which are also considered overhead and encompass the upfront costs of revenue-generating activities, like fundraising consulting fees, event planning, marketing material creation, and software subscriptions.

- Any program costs not covered by funds that are restricted to those mission-driven activities.

The majority of your nonprofit’s revenue is likely unrestricted, as common sources of unrestricted funding include:

- Most small and mid-sized individual donations

- Fundraising event revenue

- Most types of corporate giving (matching gifts, volunteer grants, etc.)

- Earned income from membership dues, merchandise sales, and service fees

- Interest and dividends from investments of your nonprofit’s reserve funds

Even though unrestricted funds don’t have to be used for specific purposes, it’s still important to keep a tight grip on how they’re being spent so your nonprofit can make the most of its funding and demonstrate holistic accountability to its entire community.

Permanently Restricted Funds

Permanently restricted funds most often take the form of endowments, which are large sums of money contributed by one or several donors. Your nonprofit isn’t allowed to spend these funds directly—instead, you’ll invest them and collect interest. Then, you’ll typically put the interest toward an initiative agreed upon by the endowment fund contributor(s).

Universities frequently have endowment funds to pay for scholarships, fellowships, and certain faculty positions. However, they aren’t the only tax-exempt organizations that can benefit from an endowment. For example, a museum might start one to provide consistent funding for new exhibitions, a hospital may have one to pay for a specific area of medical research, and a church could create one to support its missions and outreach work.

Temporarily Restricted Funds

Temporarily restricted funds come with a designation for a purpose that will eventually be fulfilled or a time period that will elapse. Once these conditions have been met, any remaining funding is released, so your nonprofit can treat it like unrestricted revenue.

These conditions most often apply to:

- Major and planned gifts

- Grants

- Corporate sponsorships (which are often designated for fundraising events)

To see how this works in practice, let’s say a major donor contributes $20,000 to a capital campaign to expand your nonprofit’s facilities. Your contractor completes the project under budget, and you only spend $19,000 of that gift. The remaining $1,000 is then released from restriction, so you look at your budget and decide to put it toward new furniture for the additional space you now have in your building (which wasn’t originally part of the campaign).

Note that temporarily restricted funding is often confused with another common term in nonprofit revenue recognition: deferred revenue. Deferred revenue refers to (typically unrestricted) funds that your organization has received but isn’t allowed to spend yet, which usually happens when supporters pre-pay for a product or service that will be delivered at a later date. For example, a recreation center may ask its supporters to pay for a class a month in advance to hold their spots, but the center can’t spend those funds until after participants take the class.

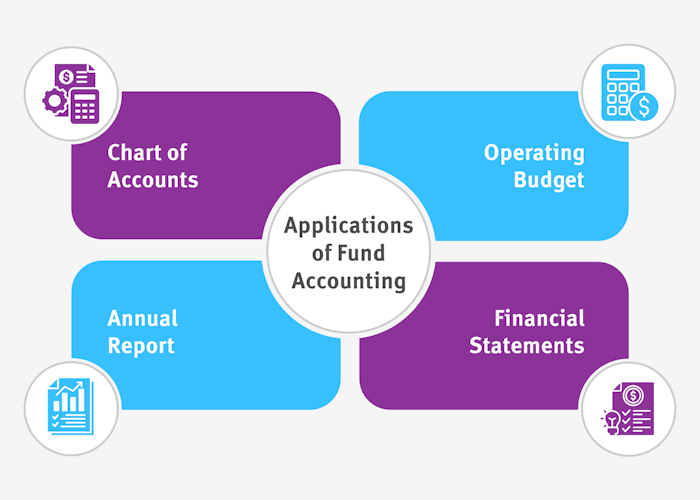

Fund Accounting Applications

Implementing fund accounting at your nonprofit most noticeably impacts how you organize your internal records. However, its implications extend to several key financial documents your organization creates, including your:

- Chart of accounts. Because your chart of accounts is essentially a directory of your organization's financial records, it should reflect your use of fund accounting. Most nonprofits divide the net assets section, which shows what your nonprofit is worth, into unrestricted, permanently restricted, and temporarily restricted categories. Your revenue section should also include its own designations for different types of restricted funds (grants from different sources, sponsorships, planned gifts, etc.)

- Operating budget. The impact of funding restrictions on resource allocation is never more clear than when your organization is creating its annual operating budget. During this process, first list where all restricted funds have been designated, then fill in the gaps in both program and overhead costs with unrestricted funding. This way, you can avoid accidentally spending restricted funds on the wrong initiatives or putting too much unrestricted funding toward a program or project that’s already paid for.

- Financial statements. The statement of activities (which details your nonprofit’s revenue, expenses, and net assets) and statement of financial position (which outlines your assets, liabilities, and net assets) both separate restricted and unrestricted funds to provide a clear picture of your organization’s financial situation for a given year. Your statement of functional expenses is also indirectly affected because fund accounting dictates which revenue goes toward program, administrative, and fundraising costs.

- Annual report. The financial section of your annual report is one of the best places to communicate transparently about your nonprofit’s use of funds with your community. Use the data in your fund accounting system to create charts and graphs that break down important financial information and demonstrate how you’ve allocated resources, especially restricted funds. Many organizations also attach their financial statements as appendices to their annual reports in case readers want to dig deeper.

If you need help setting up your organization’s fund accounting system or applying fund accounting in any of these ways, consider reaching out to a nonprofit accounting firm like Jitasa. Our experts work exclusively with tax-exempt organizations, so we’ll use our experience to ensure your system meets all of your unique needs and solve any problems that may arise. Plus, our outsourced bookkeeping and accounting services are affordable and cater to nonprofits of all sizes and missions!

Being transparent and following through on your promises to donors, grantmakers, and other stakeholders is critical to retain their support long-term. Now that you understand the basics of fund accounting, you should be well on your way to more effectively managing and reporting your finances for the benefit of your whole community.

For more information on nonprofit accounting, check out these resources:

- How to Set up QuickBooks for Nonprofits: The Complete Guide. Learn how to configure your organization’s accounting software to support fund accounting best practices.

- Grant Management: How to Secure and Track Nonprofit Funding. Dive deeper into the process of allocating and reporting a common type of temporarily restricted revenue—grants.

- 12+ Top Nonprofit Accounting Firms & How to Choose One. Explore our top picks for outsourced nonprofit accountants who can help your organization get started with fund accounting.

Partner with Jitasa to develop your nonprofit's fund accounting system and implement best practices.

Request a Quote