What Is a Fractional CFO for Nonprofits? The Ultimate Guide

Tuesday, September 3, 2024 by Jon Osterburg

If you work in the nonprofit sector, you know how important strategic leadership is to your organization’s ability to further its mission. A key aspect of this strategy is effectively managing your nonprofit’s financial resources, and the leader responsible for this task at most organizations is the chief financial officer (CFO).

However, small to mid-sized nonprofits may not have the budget to hire a full-time CFO, and an external professional working on a part-time basis could easily fulfill their needs. Fortunately, there are financial experts who provide these types of services—they’re known as fractional CFOs.

In this guide, you’ll learn all you need to know about fractional CFOs for nonprofits, including:

- What is a Fractional CFO for Nonprofits?

- Responsibilities of a Fractional Nonprofit CFO

- Benefits of Hiring a Fractional Nonprofit CFO

- What to Look for in a Fractional CFO for Nonprofits

Let’s begin by defining the role of a fractional CFO in the context of your nonprofit’s larger financial management structure.

Get affordable, tailored fractional nonprofit CFO services from the Jitasa Strategic Advisory Team.

Request a QuoteWhat is a Fractional CFO for Nonprofits?

A fractional CFO for nonprofits is an outsourced financial executive who provides strategic management services and fiscal expertise to charitable and tax-exempt organizations. Although a fractional CFO will work on a part-time or as-needed basis for each individual organization, they typically have an extensive background in nonprofit finance and often assist multiple clients at any given time.

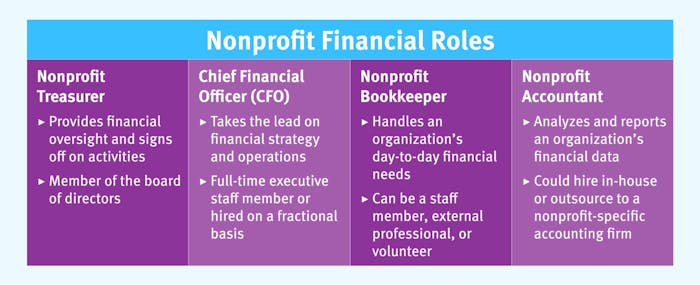

As would be the case if your nonprofit had a full-time CFO, a fractional CFO’s primary focus area is financial strategy—i.e., high-level responsibilities related to your nonprofit’s overarching goals and long-term success. To allow your CFO to concentrate on strategic tasks, your organization should have at least three other individuals on its financial team, each with their own focus:

- Treasurer: Responsible for fiscal oversight, including various approval and governance tasks, as the financial expert on your board of directors.

- Bookkeeper: Handles recordkeeping and other day-to-day financial tasks like writing checks and managing invoices at your nonprofit.

- Accountant: Manages financial data analysis and reporting tasks for your organization, such as reconciling bank accounts and filing tax forms.

Your organization’s fractional CFO will collaborate frequently with these three professionals, as well as your executive team, to ensure alignment across all aspects of your nonprofit’s financial and leadership activities.

Responsibilities of a Fractional Nonprofit CFO

Now that you have a general understanding of the role of a fractional CFO for nonprofits, let’s dive deeper into the key tasks they can complete for your organization. Of course, every nonprofit has different needs and preferences, so make sure you and your CFO are aligned on the exact services you need them to provide for your organization.

Budget Creation

Arguably the largest financial planning task your nonprofit undertakes each year is creating an annual operating budget. While budgeting is likely a team effort involving your organization’s entire leadership team, board, and accountant, your fractional CFO will take the lead on this aspect of your financial strategy.

As they develop your nonprofit’s operating budget with input from the rest of your team, your CFO will:

- Consider your organization’s priorities for the year and set specific, measurable financial goals related to them.

- Assess your nonprofit’s projected expenditures and organize them according to the functional expense categories of program, administrative, and fundraising costs.

- Review all of your organization’s funding sources (such as individual donations, corporate philanthropy, investments, and grants) and predict how much you can realistically expect to earn from each of them.

- Outline all of your revenue and expenses in one document, including detailed notes about what revenue your nonprofit will use to cover various expenses and when you expect to receive different types of funding or incur certain costs.

- Make strategic recommendations about how your organization could boost its revenue generation potential or cut unnecessary expenses so you bring in more than you spend throughout the year.

Once your fractional CFO finalizes your nonprofit’s budget and gets it approved by the board, they’ll also play a key role in recurring budget reviews throughout the year, helping to keep your spending and fundraising in line with your organization’s strategy.

Use our flexible nonprofit budget template to start planning your organization's finances.

Download for FreeCash Flow Forecasting

Cash flow forecasting is the process of predicting how cash will move in and out of your organization in the near future. While it's an essential aspect of the budgeting process, your fractional CFO will also forecast month-to-month cash flows to help your nonprofit adjust its strategy proactively in case of unexpected expenses or revenue shortfalls.

Fractional CFOs often use specialized software to predict cash flows and visualize the possible outcomes of financial scenarios using graphs and dashboards. They also rely on the statements of cash flows your accountant creates each month to evaluate how your cash inflows and outflows from operating, investing, and financing activities have changed and consider how these data points will continue to shift over the next few months or years.

Grant Management

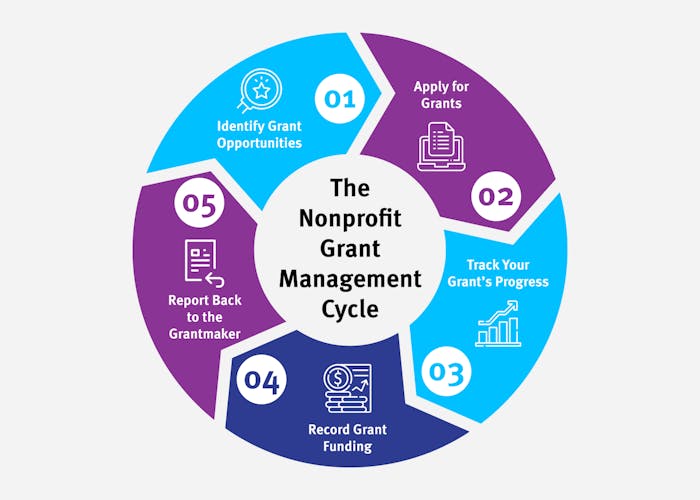

While grants provide critical funding for your nonprofit’s most important projects and programs, they can be challenging to secure and track. Your fractional CFO will work with your team on all aspects of the grant management process, including:

- Identifying grant opportunities that align with your organization’s mission, current strategic plan, and upcoming high-priority initiatives.

- Applying for grants—although it’s often helpful to work with a dedicated grants consultant on proposal writing, your fractional CFO can assist with creating grant proposal budgets and a schedule to help you get your applications in on time.

- Tracking your grant’s progress once you’ve secured one, which involves recording the amount and purpose of all grant funding expenditures and efficiently allocating other revenue toward the target initiative.

- Recording grant funding in your accounting system—your bookkeeper will likely perform the actual data entry, but your CFO will ensure the funding is recorded correctly according to the type of grant you’ve received (unconditional, contingent, or reimbursable).

- Reporting back to the grantmaker, ensuring each report aligns with their content and format requirements and is completed by the set deadline.

As your nonprofit grows, you might have multiple grants at different stages of the management process at any given time. Your fractional CFO can help you develop a tailored system of scheduling and delegating tasks that allows your organization to secure and track various grant funds effectively.

Financial Policy Development

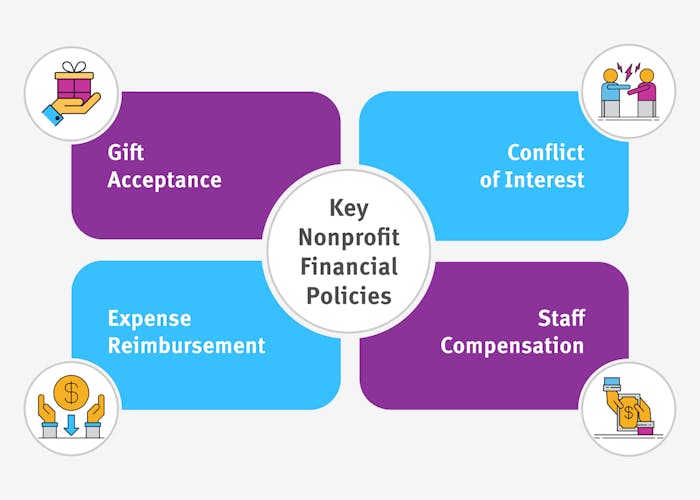

Financial policies are foundational to effective management since they provide day-to-day, organization-wide guidelines for how to handle your nonprofit’s funding. When you partner with a fractional CFO, they’ll work with you to develop new financial policies or revamp your organization’s existing fiscal policy handbook to ensure it follows industry best practices. In particular, they’ll focus on solidifying the following policies:

- Gift acceptance policy: Details the types of gifts (both monetary and in-kind) that your nonprofit can and can’t accept, as well as the conditions under which you’ll accept each kind of contribution.

- Conflict of interest policy: Defines the types of situations that constitute a conflict of interest at your organization, the procedure for disclosing conflicts, and the steps to take if a conflict is disclosed or discovered.

- Expense reimbursement policy: Outlines when and how staff members and volunteers should receive reimbursements for personal money they spend on behalf of your mission.

- Staff compensation policy: Provides guidelines for setting, reviewing, and changing your employees’ compensation—both direct compensation like salaries and indirect compensation like paid time off and healthcare benefits.

In addition to these core policies, your fractional CFO will also establish or assess your nonprofit’s internal controls, which are smaller procedures designed to prevent financial risks like fraud and theft. For example, many nonprofits require two signatures on checks written for large amounts of money. By having multiple people involved in that process, it’s easier to catch and fix errors before payments are processed, and it ensures no one person is held liable in case of accidental fraud.

Strategic Management and Leadership

This category encompasses a variety of tasks that your fractional nonprofit CFO will take part in while working closely with your organization’s leadership team. For example, they may:

- Create or evaluate the financial goals in your nonprofit’s long-term strategic plan.

- Conduct industry research to choose fiscal key performance indicators (KPIs) and set benchmarks.

- Visualize financial data through charts, graphs, and dashboards to make it easier to understand and apply to your strategy.

- Attend occasional board meetings to provide training and answer questions.

- Suggest improvements to your overall management system that will help your nonprofit mitigate risks and achieve financial sustainability.

Although the nature and extent of these strategic management responsibilities will depend on your organization’s unique financial situation, your fractional CFO should be equipped to handle many tasks in this vein that would benefit your nonprofit.

Benefits of Hiring a Fractional Nonprofit CFO

The main benefit your nonprofit will experience by leveraging fractional CFO services is gaining access to all of the expertise of a full-time chief financial officer on a part-time basis. This can save your organization a lot of time and money—recruiting, onboarding, and compensating a new executive-level employee takes significant effort and can be expensive.

Fractional CFOs for nonprofits can also provide your organization with several operational advantages, including:

- Improved financial planning through expert-developed strategies, goals, and budgets.

- Streamlined management processes that boost productivity and mission effectiveness across your organization.

- Training and development to help your staff and board members better understand your nonprofit’s finances as they apply to their roles.

- An objective perspective on your organization’s financial situation that can help you view your procedures and collected data in a new light.

Plus, fractional CFO services are typically scalable, so you can give these professionals an expanded or adjusted role as your nonprofit grows and your needs change over time.

What to Look for in a Fractional CFO for Nonprofits

If you think partnering with a fractional CFO may be right for your nonprofit, you might be wondering how to find the right professional to work with. Like with most significant decisions your organization makes, you should first finalize your budget for hiring a fractional CFO and your goals for the partnership to guide the process.

Then, conduct online research on fractional nonprofit CFO services, and reach out to other nonprofits in your network that have partnered with fractional CFOs. As you consult these resources, look for fractional CFOs who have:

- Extensive experience working with nonprofits and a strong understanding of the unique complexities of nonprofit finance.

- Skilled command of essential technology like accounting platforms, cash flow dashboards, grant management software, and your nonprofit’s central database.

- Compatibility with your leadership team and other financial professionals, since they will all need to communicate effectively to make the partnership productive.

- Positive reviews from current and past clients, especially nonprofits of a comparable size and with similar missions to your organization.

- A straightforward pricing structure that aligns with your budget, doesn’t contain hidden fees, and can be adjusted as necessary to scale services.

At Jitasa, we offer a full slate of fractional nonprofit CFO services through our Jitasa Strategic Advisory Team (J-SAT). Composed of dedicated individuals with prior experience as full-time nonprofit CFOs, our team leverages industry-leading technology to help organizations like yours work through financial challenges and achieve goals. While J-SAT works exclusively with nonprofits, we’ll partner with organizations of all sizes and missions to provide affordable solutions tailored to your needs.

If your organization is looking to improve its financial planning, management processes, and effectiveness in funding its mission-driven activities, working with a fractional CFO for nonprofits can provide all of these benefits and more. Consider which responsibilities of a fractional CFO are your organization’s biggest priorities before you start your search, and make sure to partner with experienced professionals who understand nonprofit finance inside and out (like the team at Jitasa!)

For more information on nonprofit financial management, check out these resources:

- Nonprofit Risk Management: Complete Guide + Tips for Success. Much of your fractional CFO’s work will help your nonprofit manage risks more effectively—learn more strategies for risk management in this guide.

- Nonprofit Bookkeeper vs. Accountant: What’s the Difference? Dive deeper into two of the other key nonprofit financial roles—bookkeeper and accountant—and discover why their duties are frequently confused.

- Fractional Nonprofit CFO Services | Jitasa Group. Explore the various fractional CFO services your organization can take advantage of by working with J-SAT.

Partner with the Jitasa Strategic Advisory Team for affordable, tailored fractional nonprofit CFO services.

Request a Quote