Nonprofit Form 990 Filing: FAQ Guide + How to Get Started

Friday, August 1, 2025 by Jon Osterburg

If your nonprofit has a valid 501(c)(3) status, it’s exempt from paying federal income tax, as well as most state taxes. However, this doesn’t mean your organization can completely write off tax season! To maintain your status, nonprofits like yours still have to file an annual tax return via IRS Form 990.

Rather than determining how much your nonprofit owes in taxes, Form 990 demonstrates that you’re handling funds properly and have sound financial management practices in place, meaning your organization is still worthy of its exempt status. In this guide, we’ll explain everything you need to know about Form 990 filing by covering the following topics:

Filing your Form 990 is the culmination of your annual financial activities and data collection, which should all point your nonprofit toward long-term sustainability and increased impact. Let’s get started!

Make Form 990 filing easy by partnering with the expert nonprofit accountants at Jitasa.

Request a QuoteNonprofit Form 990: Frequently Asked Questions

At first glance, filing Form 990 might seem like a confusing, taxing process. So, let’s walk through the answers to some of the most common questions about this document.

What Is Form 990?

Form 990 is the tax return document that exempt organizations complete each year and file with the IRS. The government uses this form to ensure all registered nonprofits are legitimate and financially honest, which tells them whether each organization deserves to maintain its tax-exempt status.

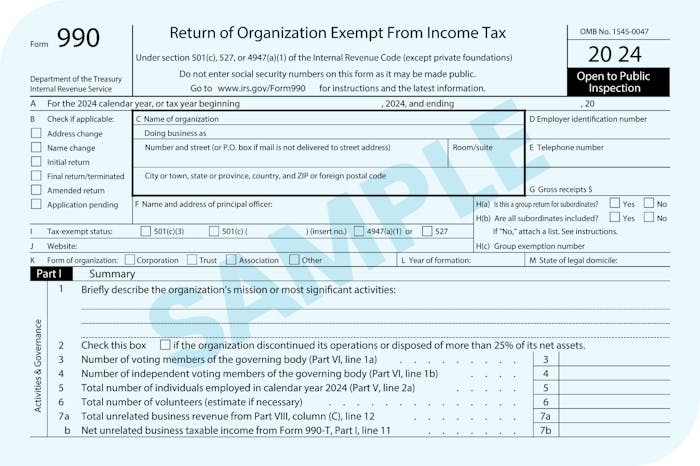

Although the IRS updates Form 990 from year to year, yours will probably look something like this example:

Does My Nonprofit Also File State Tax Returns?

It depends on what state your organization operates in. Each state government has slightly different requirements for remaining tax-exempt. You’ll likely have to do some combination of the following:

- File a separate state-specific income tax return, such as Form 199 in California or Form CHAR500 in New York.

- Send your state government a copy of your Form 990.

- Complete other forms that aren’t strictly tax returns but are still required for compliance, such as annual reports, property or sales tax exemption applications, or charitable solicitation registration renewals.

There are plenty of resources available online to help you stay up to date on your state’s filing requirements. Just make sure that if your organization operates in multiple states, you understand how to maintain compliance in all of them.

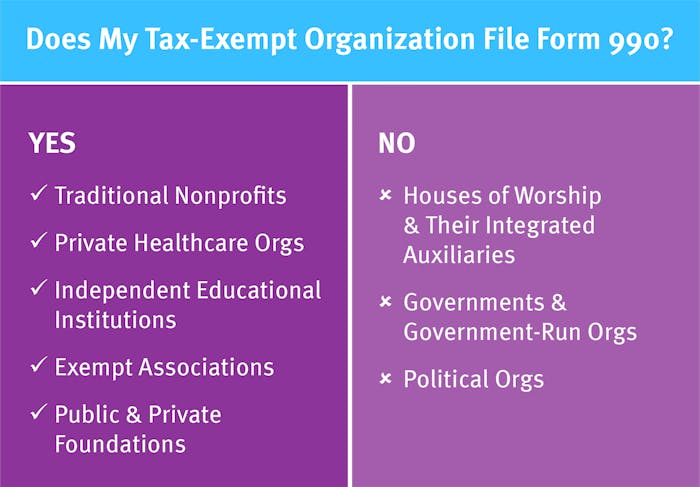

What Organizations File Form 990?

Although Form 990 is designed exclusively for exempt organizations, not every exempt organization has to file Form 990. Organizations that are required to file it include:

- Traditional nonprofits

- Private healthcare organizations and systems

- Independent educational institutions

- Tax-exempt associations

- Public and private foundations

Exempt organizations that do not have to file Form 990 include:

- Houses of worship (churches, synagogues, temples, mosques, etc.) and their integrated auxiliaries (e.g., church-affiliated schools or religious conventions)

- Governments and government-run organizations (e.g., public schools and universities or municipal hospitals)

- Political organizations (they have a separate federal return, Form 8872)

If you’re unsure whether your organization needs to complete Form 990, the answer is probably yes, but you can double-check with a nonprofit financial professional just to be safe.

Which Version of Form 990 Should I File?

There are four versions of Form 990, and which one your organization files depends on your annual gross receipts and total assets. Generally speaking, the larger your nonprofit is, the longer your Form 990 needs to be so you have space to report all of your financial activities.

Here is a quick breakdown of the four Form 990 versions and the criteria for filing each one:

- Form 990-N (e-postcard): Your nonprofit can file this form if your gross receipts total less than $50,000. Form 990-N is an eight-question online form that asks for your organization’s legal name and address, employer identification number (EIN), tax year, website URL, principal officer’s name and address, and confirmation of gross receipts under $50,000.

- Form 990-EZ: Your organization can file this form if your gross receipts are less than $200,000 and your total assets equal less than $500,000. Form 990-EZ is a condensed version of the full Form 990 and is about four pages long when printed.

- Full Form 990: Your nonprofit has to file this 12-page, comprehensive tax return if your gross receipts total $200,000 or more, or if your total assets equal $500,000 or more. Make sure to use your total assets in this calculation, not your net assets, as your total assets will almost always be a larger number.

- Form 990-PF: All private foundations need to complete this 13-page form, regardless of their total assets or gross receipts. Foundations tend to be more financially complex than other nonprofits, so the IRS requests additional, consistent information on private assets, trustees, officers, grants awarded, and other activities to ensure your organization is allocating funds properly.

Your nonprofit can save time and resources by ensuring that you’re filing the right size form (and again, checking with an accountant if you need help figuring that out!).

When Is the Form 990 Filing Deadline?

Your nonprofit’s Form 990 is due on the 15th day of the fifth month after the end of its fiscal year. If your organization’s fiscal year follows the calendar year (as most nonprofits’ do), your Form 990 deadline is May 15. If your nonprofit has a different fiscal year, you’ll need to adjust accordingly—for instance, organizations that use a July-to-June fiscal calendar (which is common among educational institutions because it roughly aligns with the school year) have to submit their Form 990s by November 15.

Additionally, your nonprofit can apply for an official extension of your Form 990 deadline as needed using IRS Form 8868. As long as your request is approved, your due date can be pushed back by up to six months.

What Happens If I File My Form 990 Late?

In the situation that you don’t submit your Form 990 by the deadline, apply and get approval for an extension, or provide reasonable cause for filing late as defined by the IRS, your nonprofit will be subject to financial penalties as follows:

- If your gross receipts are less than $1,208,500 for the tax year, the penalty is $20 per day that the return is late. The maximum possible fee is either $12,000 or 5% of your organization’s gross receipts, whichever is less.

- If your gross receipts are greater than $1,208,500 for the tax year, the penalty is $120 per day that the return is late, with a maximum fee of $60,000.

If your nonprofit fails to file Form 990 for three years in a row, your nonprofit’s 501(c)(3) status will be revoked. In this case, you’ll need to file Form 1023 again and pay additional fees to re-register your organization as tax-exempt. Long story short, make sure to file your Form 990 on time!

Stay on top of the essential financial deadlines with our Month Close Calendar Template.

Download for FreeWhat Do I Do About My Form 990 While My Nonprofit Conducts an Independent Audit?

If your nonprofit is planning to undergo an independent financial audit, we recommend doing so before filing your Form 990 and applying for an extension as needed. That way, you can update your return with relevant details from your audit report and changes you’ve made to your financial management practices based on those results before submitting it. Plus, you won’t have to navigate two time-consuming financial processes at the same time!

Preparing for an audit will also prompt your organization to take some preliminary steps that will help you get ready to file your Form 990, such as compiling financial statements and cleaning up your accounting records. Make sure all of your audit resources are easily accessible so you can reference them again as your tax return deadline approaches.

Note: An independent financial audit is different from an audit conducted by the IRS, which is less common for nonprofits than for individuals and for-profit organizations. However, an IRS audit can be triggered if you don’t file your Form 990 for one year or reviewers discover a discrepancy in it.

Who Has Access to My Nonprofit’s Form 990?

All Form 990s are required to be publicly available for at least three years after filing, meaning anyone can find the information on your forms once the IRS publishes them. Be careful not to include sensitive information in your returns—for example, Social Security numbers are strongly discouraged due to concerns around (and past incidents of) identity theft.

Nonprofit research companies like Guidestar use Form 990s to provide donors with additional information about organizations they’re interested in supporting. Your nonprofit can choose to register with Guidestar to make this information more accessible and boost transparency. Additionally, you can publish your Form 990 on your organization’s website and include data from it in your annual report so it’s even easier for interested donors to find.

Why Form 990 Filing Is Important

Your Form 990 is arguably the most critical financial report you compile each year. There are many reasons to take this process seriously and treat it with care, including that:

- It allows you to maintain your nonprofit’s status. As discussed previously, filing a Form 990 each year is essential for keeping your nonprofit’s 501(c)(3) status. Plus, avoiding the penalties for failing to file is good for your organization’s financial health.

- It holds your organization accountable. Filing taxes each year is a good opportunity to regularly review your organization’s financial information and identify strengths and areas for improvement.

- It promotes financial transparency. Because Form 990s are public records, donors, funders, and community members can gain valuable insight into your nonprofit’s finances when they look up your past tax forms. This can instill confidence that boosts supporter acquisition and retention.

- It proves your nonprofit’s integrity. Carefully preparing your Form 990 not only shows that your organization is acting honestly (and unfortunately, there are often news stories circulating that show this isn’t always the case) but also can be helpful in identifying and mitigating financial risks.

Beyond just ensuring compliance, accurately filing your nonprofit tax returns is essential for effective financial planning and maximizing these benefits!

How to File Your Nonprofit’s Form 990

There are two main ways you can go about completing your Form 990: filing on your own or working with an accountant. Filing on your own is possible, but if your leaders don’t have a background in accounting, it can be challenging to keep up with changes in the tax system and resolve issues that may come up during the process. If you choose this method, you should also note that all nonprofit tax returns have to be filed electronically.

The best way to make sure your Form 990 is completed correctly and on time is to bring on an accountant who has experience working with nonprofits. Since hiring a new full-time staff member can be expensive and time-consuming, many organizations instead choose to outsource their tax preparation and other accounting needs to nonprofit-specific firms whose services align with their goals and budgets.

We may be a little biased, but we recommend Jitasa as the best nonprofit accounting firm to file your organization’s Form 990. Our experts have completed tax returns for nonprofits of all sizes and missions, meaning they have experience with many different financial situations and can meet your organization’s unique needs—all at an affordable flat rate! Plus, you can partner with Jitasa just for tax filings, or you can work with us year-round to cover all of your accounting, bookkeeping, operational, and advisory needs.

Jitasa accountants have completed 5,000+ federal and state nonprofit tax filings—and we're ready to help with yours, too!

Explore Our Tax ServicesForm 990 filing is an unavoidable but fulfilling part of running a financially responsible nonprofit. Learning about your Form 990 is the first step in ensuring a successful tax season. The next step is completing the form, which is much easier when you partner with a nonprofit accounting firm like Jitasa!

For more information on nonprofit tax filings, check out these resources:

- Form 1099 for Nonprofits: How and Why to Issue One. Discover another important tax form, Form 1099, which your nonprofit will need to issue to any independent contractors you work with.

- In-Kind Donations: The Ultimate Guide + How to Get Started. Dive deeper into one of the most challenging types of contributions to report on your Form 990 (but also one of the most beneficial for your mission!): in-kind donations..

- 12+ Top Nonprofit Accounting Firms & How to Choose One. Explore our recommendations for outsourced nonprofit accounting services to help you file your annual tax returns.

Simplify Form 990 filing—and all of your other finanical management needs—with Jitasa's nonprofit accounting. services.

Request a Quote